Whitepaper

A Radical New Approach to the Endowment Model

By Euan Finlay, Stan Miranda

1 February 2019

Is there a more attractive alternative to the Endowment Model of Investing?

Today? No. But we raise this question as the universe of high returning strategies that have little correlation with traditional financial market returns continues to expand. Five years into our pursuit of so-called ‘Alternative-Alternative’ strategies, we are close to having sufficient options to build a fully diversified portfolio targeting 8% annual returns with near zero correlation to equities. This strategy, however, carries its own set of esoteric risks.

Our “insights” about risk management stem from our somewhat unique perspective of risk which is that there are some risks that we want to take and for which we believe we will be paid handsome returns and then there are risks that are quite simply not paid for.

One of the core tenets of the endowment model of investing, as codified by David Swensen of Yale University, is an equity biased asset allocation. This is based on the premise that long term investors with the requisite time horizon to accept the short-term drawdown risk of owning equities would likely be rewarded with higher returns over multiple decades. While this core principle of the endowment model is likely to hold over the long term, the future economic environment of low real economic growth and commensurately low returns from traditional asset classes has us re-thinking the optimal asset allocation over the medium term (next 10-15 years). Endowment style portfolios that targeted and earned returns of 9% per annum over long periods of time are now expecting returns closer to 6% per annum, with public equities returns expected by most equity specialists to be closer to 5% per annum. Whilst we are not predicting an economic recession in the next 12 months, we are preparing for the possibility of a downside scenario which results in the absolute value of a public equity portfolio falling by 20% or more, and requiring up to a decade to recover. We are reminded that an index weighted global public equity portfolio initiated in 1999 did not recover capital until 2013 (inflation adjusted). Furthermore, we expect the volatility of returns of traditional public market asset classes to return to historic highs (around 20% annualised for public equities) as we move from an environment of quantitative easing to quantitative tightening. The experience of Q4 2018 could well be a precursor to the type of volatility that we could experience in the coming years. Are we truly doomed to low returns, deep drawdowns and higher volatility, or is there an alternative?

There is an alternative strategy to the traditional endowment model that leaves us shielded from the increasing gyrations of financial markets. Such a strategy relies on a diversified portfolio of investments whose returns are tied to very specific idiosyncratic risks not related to any aspect of financial markets and not related to each other. We refer to these investment strategies as the “alternative alternatives”. We believe that such a diversified alternative alternatives portfolio can generate average returns over the long-term of c.9% per annum with annual volatility below 10%.

What we are aiming to present in this chapter is a radically different approach to institutional investing which could be adopted on its own or as an adjunct to a classic endowment-style portfolio. We chose this issue of Insights to bring this to your attention as we believe the universe of available Alternative Alternatives strategies will soon reach a level of investibility that can constitute a well-diversified multi-strategy portfolio, virtually disconnected from the global financial markets. Below, we provide definitions of the various underlying strategies within the “alternative alternatives” universe, their expected returns and sensitivity in economic downturns, example asset allocations for institutional investors and the key considerations when implementing such a strategy.

Definition of “Alternative Alternatives”

We define “alternative alternatives” as investments which generate returns by assuming risks which are idiosyncratic and uncorrelated with both traditional market risks (such as equity, credit and interest rates) and more commonly accepted alternative asset classes which are similarly exposed to financial market risks (such as hedge funds, private equity and real estate). Alternative Alternatives (or “Alt-Alt”) strategies generally pay investors for an identifiable risk, with a large universe of repeated events enabling investors to price that risk – but such risks having nothing to

do with financial markets. The limited correlation of alternative alternatives can be a function of either the nature of the risk (e.g., event risk related to nonfinancial events) or the nature of the underlying asset (e.g., ownership of or lending against an asset which has limited correlation to traditional asset classes).

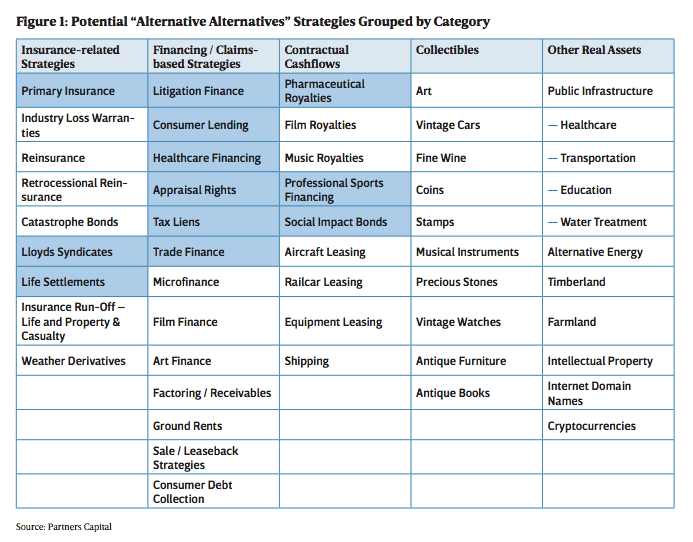

We have broadly grouped the alternative alternatives strategies into five categories: insurance related, financing / claims-based strategies, contractual cash flows, collectibles and other real assets, which are defined below.

Insurance-related strategies: These are not new. For centuries, financial investors have had insurance syndicate-based investments available to them, such as Lloyds of London. The insurance industry facilitates the transfer of non-corporate event risk. Investors receive a premium for assuming the risk of loss from events such as natural disaster, accidents and mortality.

Financing or claims-based strategies: Default risk is the primary driver of returns for financing or claims-based strategies. Most default rates and related loss ratios in corporate credit strategies are typically correlated with events in the general economy and the corporate earnings cycle. However, to the extent that the default risk is driven by idiosyncratic factors other than corporate earnings or to the extent that the loan is collateralised by assets which have limited correlation to corporate earnings, such financing strategies have many of the characteristics of alternative alternatives. Examples of such financing could include loans to life sciences companies whose underlying drugs have limited sensitivity to the economic cycle, or a claim against the outcome of a litigation (see the private debt asset class section for an overview of litigation funding).

Contractual cash flows: These could include royalties associated with drug sales, technology licensing revenue and entertainment sales (music and film). Leasing strategies also represent contractual cash flows which are related to specific assets such as aircraft, ships or railcars. We would also include other esoteric assets in this category which generate cash flow streams, for example, social impact bonds whose performance is linked to the creation of positive social outcomes for underlying members of society.

Collectibles: many investors already view collectibles including fine art, vintage cars, antiques and fine wines to be part of their investment portfolios. Over the years, a small number of third-party asset management businesses have been launched to attempt to make collectibles an institutionally investible asset class, with limited success. We tend to avoid asset classes where there is no income stream and no economic utility, as the absence of these makes valuation difficult.

Other Real Assets: while infrastructure is classically considered part of the traditional alternative investment universe, there are certain types of infrastructure which have return drivers which

are less correlated to the broader economy, for example, public sector infrastructure, where revenues are driven by public usage.

Figure 1 overleaf provides the universe of potential alternative alternative strategies, with those highlighted in blue being those that Partners Capital clients have exposure to currently. We acknowledge that several could belong in more than one category and several may defy our efforts at categorisation.

Expected Returns and Downside Resilience of Selected Alternative Alternative Strategies

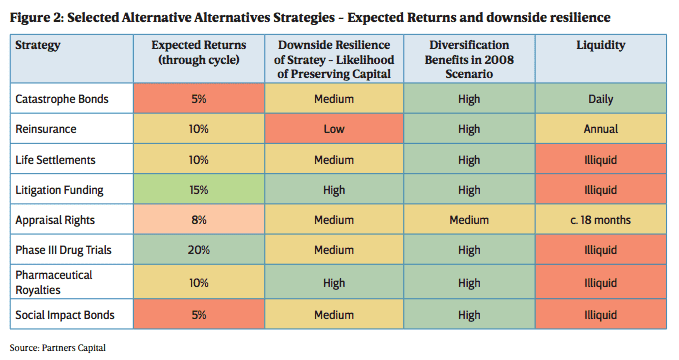

Alternative Alternatives are risky investments. We do not believe in risk-free returns. As we are aiming for relatively high returns, we should expect each Alt-Alt strategy carries with it moderate to high risk. Figure 2 overleaf shows the expected returns, downside resilience, diversification benefit and liquidity profile of a subset of the alternative alternatives in the table above. We have selected this subset due to Partners Capital having allocated capital or significant research resources to each of these sectors. While the expected return and downside resilience of each of these

strategies on a standalone basis varies significantly, what they have in common is the tremendous diversification benefit that they would each provide to a multi-asset class portfolio in a “2008 style scenario” where traditional risk assets fall dramatically in value.

If we take reinsurance as an example, we expect to generate 10% per annum over the cycle from our exposure to the asset class. The variability of that return around the expected mean is significant as insured losses in any given year can be large, driven primarily by the prevalence of natural disasters. However, ex-ante, there is no reason to believe that a natural disaster will occur concurrently with an economic environment which results in declining valuations of traditional asset classes.

Over the last five years, due to the marked portfolio construction benefits, we have been increasing the allocation to alternative alternatives within client portfolios. This is most notable within the

Partners Capital Phoenix Fund II, our pooled vehicle of private debt and uncorrelated investment opportunities, which is now around one third invested in Alternative Alternatives. Accordingly, the average Partners Capital client has over 5% of their portfolio invested in Alternative Alternatives today.

Radical Amendments to the Endowment Model

We advise many veteran investment professionals who, in their daily lives, take on extreme levels of financial risk, be that trading liquid financial instruments or for others dedicated to private equity or debt investing. A handful of such clients hired us explicitly to hedge a large part of their personal balance sheets against financial market risk and provided us with mandates to generate high returns uncorrelated with the rest of their balance sheets. Such mandates have given greater scale to our activities in Alt-Alts, hence we have come to see the asset class as sufficiently mature

and diversified, such that it could stand on its own as a viable alternative to the classic endowment model.

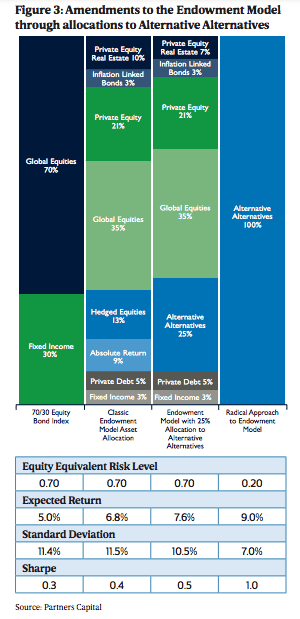

Figure 3 overleaf shows the potential improvement to risk-adjusted returns of migrating a classic endowment portfolio to one that is 25% invested in Alt-Alts and to one that is 100% Alt-Alts. The endowment portfolio with a 25% allocation to alternative alternatives has an expected return that is 0.8% per annum higher than the traditional endowment model, with similar equity equivalent risk but an expected standard deviation which is 1% lower.2

The more radical alternative to the endowment model with 100% in alternative alternatives shows an improvement to an 9% return, but with significantly lower overall volatility and minimal beta to public equity markets.

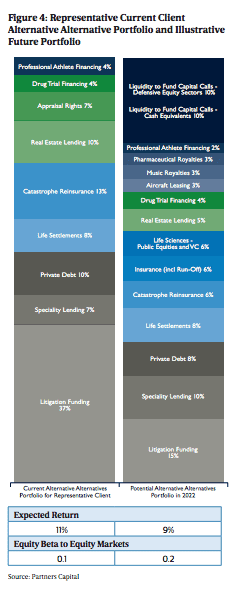

As stated above, Partners Capital currently have clients who have embraced this radical approach to endowment investing, developing portfolios exclusively built with alternative alternative strategies. In Figure 4 overleaf, the left-hand chart shows the current portfolio of a representative client who has pursued this strategy. The portfolio has been built to generate a double-digit annual return but with minimal correlation to equity markets, particularly in the event of a significant drawdown. Accordingly, it is dominated by strategies which have little reliance on GDP growth or the earnings cycle for the generation of returns, including litigation funding, life settlements and catastrophe insurance.

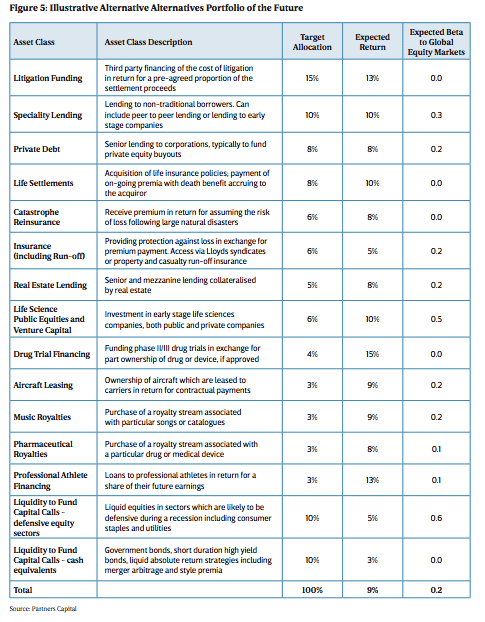

Figure 4 overleaf also includes the target asset allocation for our alternative alternatives portfolios of the future. The specific allocations are somewhat illustrative at this stage and will ultimately depend on the relative attractiveness of the specific asset classes in the coming years, as well as capacity with high quality mangers. The illustrative target portfolio would have a 20% allocation to liquid strategies to pay capital calls from the illiquid investments. This liquid allocation would include a combination of public equities, skewed to those sectors with revenue streams that are least sensitive to the economic cycle, including consumer staples, healthcare and utilities, and to asset classes with no directional equity market exposure including government bonds, short duration high yield bonds and liquid absolute return strategies. This Alt-Alt portfolio of the future will also include a number of strategies that have been around for many years, but which are new to us, including music royalties, pharmaceutical royalties and investments in early-stage life sciences companies (both public equities and venture capital). These will serve to further diversify the sources of return within the portfolio.

Figure 5 overleaf provides a brief description of each of the strategies in the target portfolio along with their expected return and expected beta to global equity markets. We believe that a portfolio constructed in this manner could generate 9% per annum over the long term with a beta of c.0.2 to global equity markets.3

Key Risks of Alternative Alternatives

Alternative alternatives as defined herein certainly sounds like the holy grail of investing -high returning investment strategies with minimal correlation to traditional asset classes or the economic cycle. This begs the question of why an investor would ever allocate to anything other than alternative alternatives. As you should expect, there are a number of major risks associated with even a highly diversified portfolio of Alt-Alt strategies, whether it is a stand-alone strategy or a significant allocation complementing an endowment-style portfolio. These include:

— Difficulty in performing diligence on these asset classes: many alternative alternative investment strategies are nascent with limited prevalence of institutional quality asset managers and less

information on the prior investment returns generated within the industry. By virtue of the short histories of such asset classes, due diligence is far less rich than for longer-lived asset classes.

Therefore, due diligence focused on these strategies generally require more intense industry research to understand the value chain, the market participants and likely return distributions.

— Most Alt-Alt strategies are small niche strategies where returns can be easily collapsed by large capital inflows to the category as other investors discover the asset class. It is down to us as

investors to take an objective view on the impact of the supply of capital for a constrained set of opportunities, but the short lives of some of these asset classes make it difficult to estimate this

relationship with a high level of confidence. For example, the expected return of the tertiary life settlement asset class has fallen from 18% in 2015 to 13% in 2019 due to the increase in the capital raised to access the asset class from institutional investors. This significantly reduces an investor’s margin of safety for assuming the risks inherent in the life settlements asset class, most notably the longevity of the underlying individuals whose life insurance policies the investor has acquired.

— “Coincidence” risk: while there is generally limited causation between the broad economic environment and the environment in which certain alternative alternative strategies perform, they could occur concurrently. For example, Q4 2018 was a particularly poor environment for catastrophe reinsurance due to the insured losses associated with a number of large catastrophic events. These occurred coincidently with the second worst drawdown for global equity markets since 2008. Thus, the reinsurance allocation provided no diversification benefit at all in the environment over the last 10 years when it was most required. Accordingly, ensuring sufficient diversification within the portfolio of alternative alternative strategies is important to mitigate this “coincidence risk”.

Having spent the last five years developing alternative alternative portfolios around these strategies, we believe that we have accumulated deep and differentiated expertise in the sector with access

to a number of the higher quality exponents of the strategies. This gives us the confidence to manage mandates focused exclusively on alternative alternative strategies, and to certainly significantly increase the allocation to such strategies from the current average allocation of 5% for Partners Capital clients as the relative attractiveness of these strategies improves relative to both traditional asset classes and mainstream hedge fund strategies.

1 These estimates of performance returns are based upon certain assumptions which should not be construed to be indicative of actual events that will occur. There is no assurance that the performance presented will be achieved.

2 Expected returns are hypothetical returns which are based on forward-looking assumptions, which have certain inherent limitations. Unlike actual returns, hypothetical returns do not represent actual trading. Hypothetical returns presented do not reflect the deduction of Partners Capital’s fees. Actual returns may differ materially from those reflected. There is no guarantee that the

hypothetical return assumptions presented will be realised.

3 This estimate of performance returns is based upon certain assumptions which should not be construed to be indicative of actual events that will occur. There is no assurance that the performance presented will be achieved. Please see important Disclaimers at the end of this material.