About Us

About Partners Capital

For over two decades, we have been the trusted partner to some of the world’s most sophisticated investors, delivering deep investment insights and a disciplined, risk-aware approach. Guided by our Advanced Endowment Approach, we build resilient portfolios that harness a global range of opportunities, investing alongside our clients to drive long-term success. With expertise across every asset class and strategy, we combine analytical rigour with the agility to adapt as markets evolve. We continuously refine our approach to stay ahead and help our clients superior outcomes achieve for decades to come.

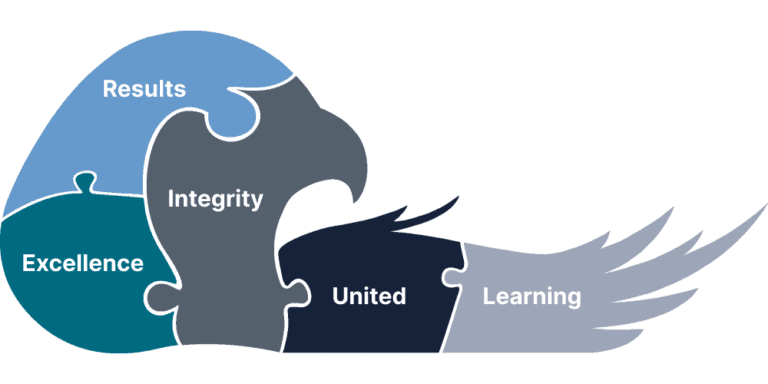

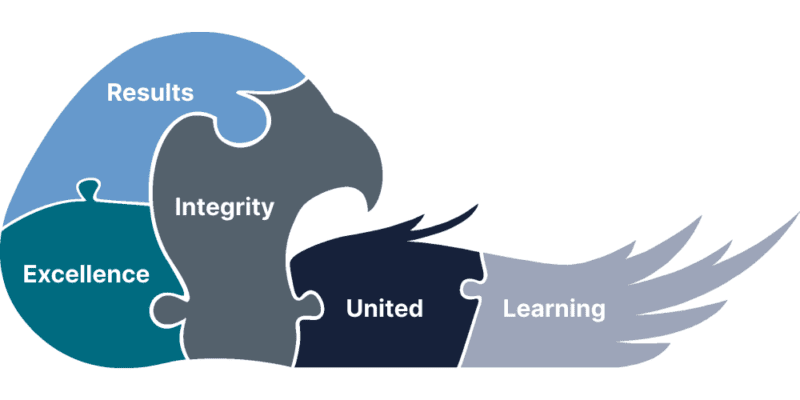

Our Core Values

Competitive Edge

Our Advanced Endowment Approach (AEA) brings together best-in-class asset managers, a full spectrum of alternative investment strategies, and innovative portfolio construction to strike the right balance between seeking excess returns and portfolio resilience.

We avoid the typical conflicts inherent in the traditional asset management industry. We allow no incentives to influence our portfolio choices other than explicit and agreed performance fees on the overall performance of a client’s investment performance. A portion of our employee compensation is deferred and invested in the same pooled vehicles in which our clients are invested. When partnering with asset managers, any benefits from our global scale, for example fee reductions, are passed directly to our clients.

We recruit team members from some of the most highly respected firms in the investment industry in the belief that it takes one to know one. In simple terms, it takes great investors to find great investors.

Our scale provides the resources needed to develop advanced investment solutions in partnership with our managers, while also allowing us to be opportunistic during times of market dislocation. Our deep networks across the asset management industry allow us to partner with exceptional managers before they close to new relationships.

We are part of a global network based on our eight offices in North America, Europe and Asia-Pacific. We are ‘locals’ in all the key global investment markets.

Many of our private clients are senior leaders is distinguished investment firms. They continuously test and challenge our investment thinking motivated by our joint effort to optimize their individual investment programs.

Our Clients

Since 2001, Partners Capital has served some of the world’s leading investors - from founders and senior partners of top private equity firms to prestigious endowments, foundations and sophisticated family offices globally. Often described as the "money manager to the money managers," we deliver independent, conflict-free advice and portfolio management.

We design tailored, multi-asset class portfolios built around each client’s risk profile, time horizon, liquidity needs, tax considerations and investment goals. In addition to fully diversified portfolios, we also partner with larger family offices and institutions to manage specialised mandates focused on specific asset classes or investment themes.