Investor Perspectives

2024 Co-Investment Year In Review

5 February 2025

2024 Co-Investment Year In Review

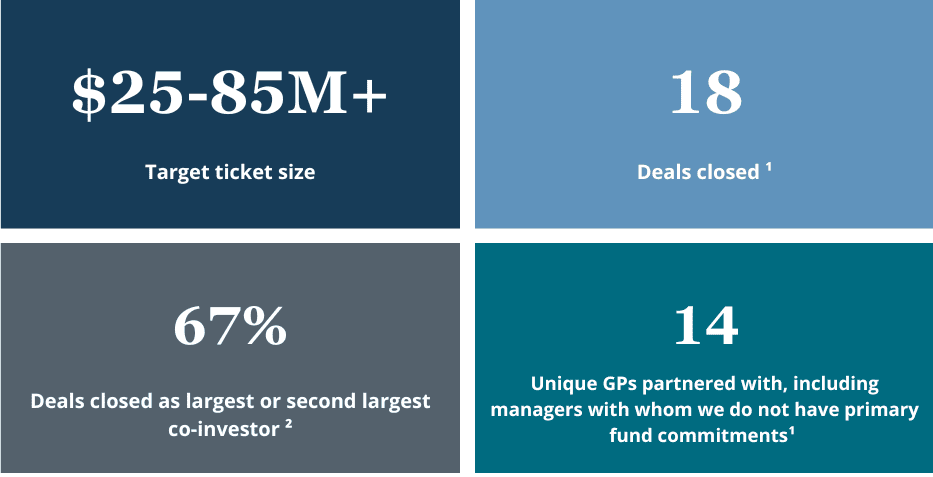

In 2024, our co-investment team achieved significant milestones, closing 12 new platform co-investments in the second half of the year, while increasing the average check size without raising the average Total Enterprise Value (TEV). We also strengthened our team with senior and junior hires and expanded our network by adding new sponsor partners to our program.

Key Themes Driving 2025 Co-Investment Growth

Stuck Funds

Fundraising has consolidated in larger funds, with many “stuck funds” remaining in the lower middle market and middle market. While total buyout capital raised in the U.S. slipped by 25% from $314B in 2023 to $236B in 2024, the number of U.S. buyout funds closed declined even further by 56% from 578 to 257.3

Low DPI

Firms continue to seek DPI in alternative ways given lag in exits over the past 2-3 years. This has resulted in a surge of:

- Mid-life minority ownership sales

- Single-asset continuation vehicles

- Pre-IPO recapitalizations.

Intermediaries

General Partners (GPs) are leaning more on intermediaries to secure co-investment, as evidenced by the 20% YoY growth in deals shown to Partners Capital by placement agents.

Partner of Choice

In 2024, we continued to be the partner of choice for both existing and prospective GP relationships, who seek co-investment partnership with us due to:

Flexibility to Invest Discretionary Capital at Scale

We are writing full discretionary tickets $50M+ across a range of structures, including:

- Traditional co-investments

- Continuation Vehicles (CVs)

- “Mid-life” minority recapitalizations

Speed and Certainty

Our clear and streamlined investment process allows us to close on investments in as short as eight days.

Short and Long-Term Partnership Mentality

We are a value-add partner to our GPs through, providing:

- Firm commitments ahead of LOIs, including Equity Commitment Letters (ECLs) and Equity Support Letters (ESLs)

- Support for long-term fundraising efforts through our scaled primary funds program

Dedicated, Direct Investing-Oriented Team

Our team brings deep private equity experience that understands what it means to support a GP. In 2024, we further strengthened our team with key hires:

- Jennifer Fox Bensimon, Managing Director (Previously at Trilantic North America & LNK Partners)

- Jack Oelhafen, Associate (Previously at BBH Capital Partners)

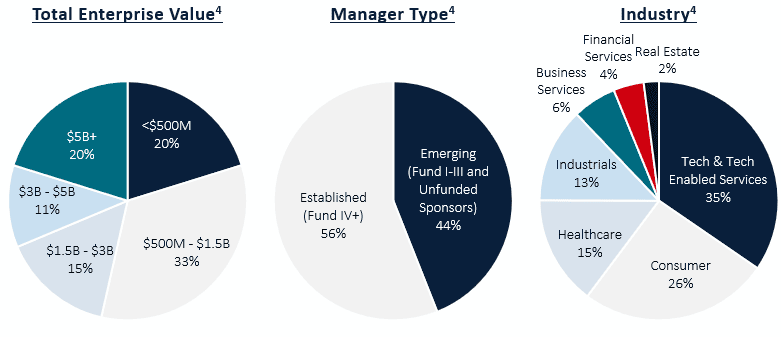

Co-Investment Portfolio Breakdown (as of December 31, 2024)

In Case You Missed It

We are delighted to share our partnership with Dunes Point Capital, LP, a premier private equity firm with whom we’ve built a long-standing and trusted relationship, on their investment into Eastern Communications Ltd. Dunes Point Capital’s exceptional track record has been built on truly differentiated approaches to driving operational value creation. We look forward to the growth opportunities ahead. Read the full press release.

Footnotes

1 Includes all deals and capital committed to platform and add-on investments in 2024.

2 2024 platform investments for which Partners Capital has available data.

3 Source: PitchBook Data, Inc.

4 Active platform investments committed to as of 31 December 2024 for which Partners Capital’s co-investment team has full oversight.