Investor Perspectives

Apples and Oranges: The Power of Equity-Like Risk Measurement

12 July 2023

There is a common saying when comparing unlike things – that comparing them is like “apples and oranges”. Nevertheless, those fruits are usually sold the same way, by weight or by count. Similarly, in this post, we explore how to compare securities across asset classes through the lens of equity-like risk.

Risk is complex. Threats to your portfolio can come in many shapes and sizes, including the market, inflation, currency, and politics. However, all these types of risk are different and can be tough to compare. Trying to boil risk down to a single number is a tall order. An investor in the stock market might lean on return-based metrics such as standard deviation of returns (or volatility), maximum drawdown, and value-at-risk, but will be at a loss for measuring the risk of any fund that does not have consistent return data (e.g., venture capital and private equity funds). To combat the incongruity of risk measures across the investment landscape, at Partners Capital, we employ a single measure: ‘equity-like risk’.

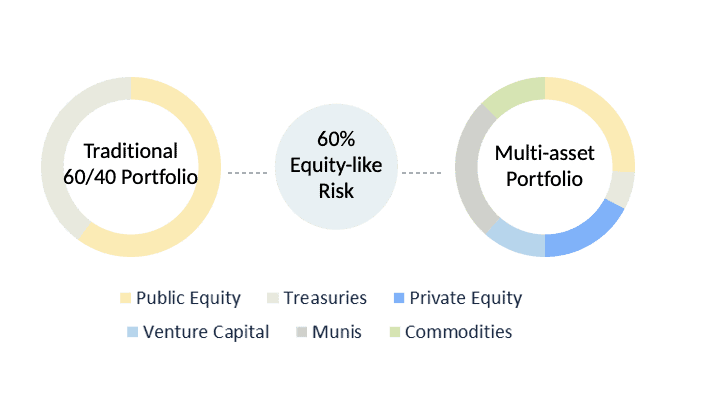

Equity-like risk is an attempt to recast all the different types of risk into equity terms, quantifying both public and private investments with comparable risk measures. It lets you compare your recent property investment to your Apple stock purchase. Why do we use this measure? Equity exposure drives returns in most investment portfolios.

We measure this equity-like risk by first calculating exposures (also called betas) to key market risks and then translating each asset class risk into its equity equivalent. For example, a bond portfolio may consist of 20% high-yield credit. High-yield credit typically has a 0.6 beta to equities. That means that the 20% high-yield credit allocation increases the bond portfolio’s equity-like risk by 12% (0.6 x 20%).

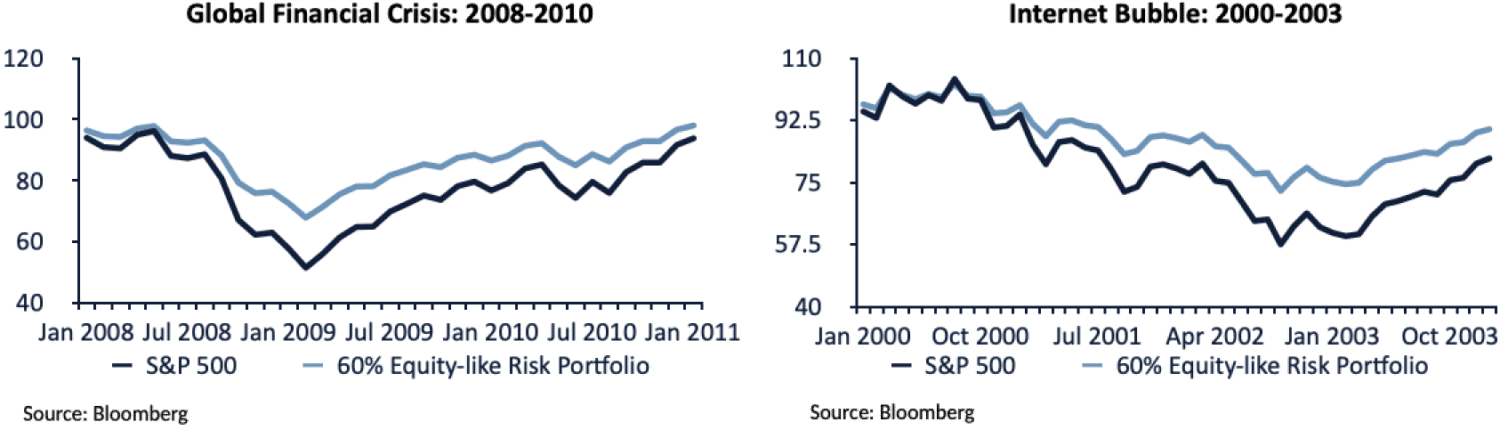

The benefit of this metric is that it makes performance predictable relative to the market. A hypothetical portfolio with a 60% equity-like risk would be expected to capture 60% of the equity market return. In the context of the 2008 Financial Crisis – where the peak-to-trough loss was -51% (Oct 2007-Feb 2009) – the hypothetical portfolio would have been expected to lose approximately 30% of its value. Understanding a portfolio’s performance in stormy weather is the best way to avoid drowning.

Although the stock market is not currently at 2008’s crisis levels, the last 12 months have been another period characterized by volatility and economic slowdown. Looking ahead, we expect slowing economic growth combined with above-target inflation and fluctuating interest rates over the intermediate term. Positioning in this uncertain environment is difficult, to say the least. Your fruit can turn sour, become rotten, or get bruised in transit. The best we can do is to gain a whole-portfolio view of the risks to protect your capital.

For more information on our thinking around risk management, please click here to read Partners Capital Approach to Risk Management.