Investor Perspectives

Five Key Strategies for Navigating UK Tax in Investment Portfolios

4 July 2024

This is a financial promotion. Your capital is at risk, the value of investments may fall and rise, and you may not get back the full amount invested.

The UK General Election will be a catalyst for change right across the political and financial landscape. Post 4 July, the next government will likely need to make spending cuts or tax increases in order to meet its manifesto and political targets. While the full wave of the impact will take a few months to be felt, the reality is that many resident non-domiciled investors face losing their tax status resulting in their worldwide assets being subject to UK tax.

How can these investors optimise returns on assets that become subject to UK taxation? And for those investors already subject to UK tax, how can they pivot to a more tax efficient strategy?

Building Benefit

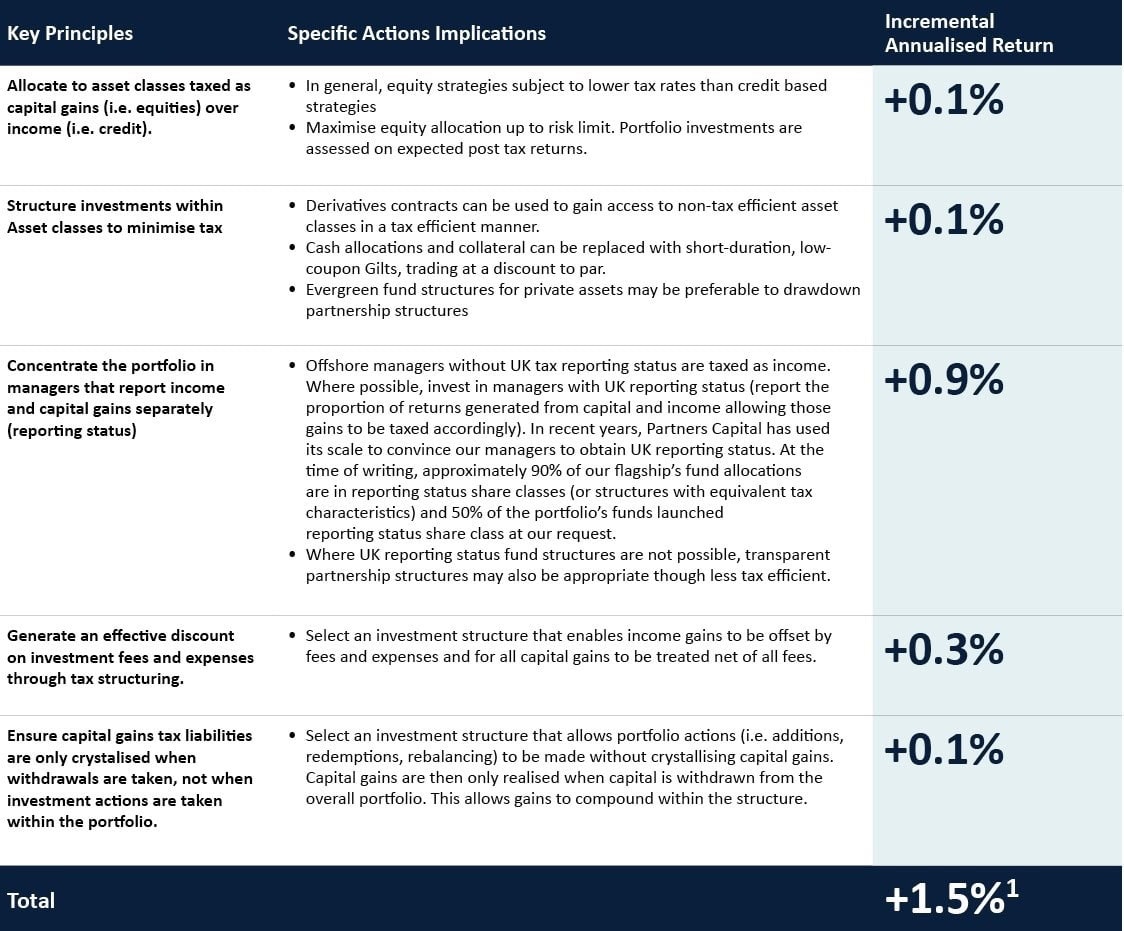

Over the past 20+ years Partners Capital has developed five strategic principles which govern the construction of portfolios for our UK tax paying clients. The application of these principles has the potential to add c. 1.5% to post-tax returns per year, with a much higher proportion of capital gains taxed at the lower rate of 20%, compared to similar strategies which optimise pre-tax returns but are subject to higher taxation rates.

Five Strategic Principles

Below we outline the five key principles for UK tax efficient investing, figures assume current tax rates and a 20-year time period, we note that we have not included any further potential benefits that are possible in respect of inheritance tax.

Given the current political backdrop selecting investment portfolios on a post tax return basis will be key for any investor resident in the UK and action should be taken within this current tax year. Partners Capital has been investing for UK taxable clients for over 20 years and offers a full endowment solution optimised for post-tax returns.

For more information on this or other key investment issues contact us directly or visit our Intellectual Capital Library.

Disclaimer

Partners Capital are not tax advisors. Tax treatment will depend on the individual circumstances of each client and is subject to change. Clients should consult their own tax advisors to understand the tax treatment of a product or investment.

1. Hypothetical return expectations are based on simulations with forward looking assumptions, which have inherent limitations. Such forecasts are not a reliable indicator of future performance.