Investor Perspectives

Tech Entrepreneurs: Are You Maximising the Value of Your Personal Wealth?

6 January 2025

Many tech entrepreneurs lack the tools to optimally manage the wealth they generate from their businesses. This leaves them overexposed to market volatility, while also missing out on return-enhancing opportunities. Here’s why a customised, professionally managed multi-asset class approach is often a good match for this group of individuals.

After spending years building successful businesses, founders of innovative tech companies often find themselves with neither the right resources nor time they need to manage their personal wealth. The result is that they can end up with highly concentrated portfolios of investments in their own company and other technology stocks, with cash or cash-like investments as a safety net. Over time, this approach often results in them missing out on returns while also needing to stomach significant volatility.

At Partners Capital, we believe entrepreneurs can achieve consistent, enhanced returns by allocating capital across several asset classes and investment strategies, such as absolute return hedge funds, private equity, and real estate, that have limited correlation with their existing tech-oriented equity holdings. Over time, this approach can meaningfully increase a tech entrepreneur’s wealth, bolstering capital available for their family, philanthropic, and other business endeavours.

How tech entrepreneurs’ personal investment strategies evolve

Like all first-time wealth accumulators, an entrepreneur’s risk profile and investment strategy tends to evolve as their wealth grows over time. As that happens, their investment management needs also change. There are three main phases to this evolution:

- Barbell. Here, the entrepreneur has one side of the portfolio concentrated in a single company stock, or select few stocks, usually tech-oriented. An entrepreneur may have 90%+ of their wealth invested in their company’s stock, leaving them exposed to significant single-asset risk. Realising that a tech-oriented equity allocation is risky, the entrepreneur also creates a safety net at the other end, by holding capital in cash or making cash-like investments, such as municipal bonds. This is a reasonable initial approach that reduces some of the single-asset risk in their portfolios.

The problem here is that the mindset of a barbell approach becomes entrenched. Over time, the portfolio can become overweight cash or bonds, forgoing upside. Additionally, the entrepreneur may overlook opportunities to reduce concentration in their company’s stock by generating liquidity via the secondary market. While single-asset concentration is likely the driver behind the initial wealth creation, for those seeking to keep and grow that wealth, a diversified approach typically leads to better results. - Cherry-picking. In the second phase, the entrepreneur comes across angel and venture-type investments from people in their own personal network. These investments can be a source of outperformance, especially where the entrepreneur is uniquely positioned given their domain expertise and personal network. However, these investments tend to be tech-oriented and so offer limited risk mitigation to the entrepreneur’s existing investment portfolio.

- Institutional management. The third phase begins as the entrepreneur finds that the self-managed approach in phases one and two leads to suboptimal outcomes. The need to manage their wealth professionally against a set of investment objectives and policies becomes clear. This involves adding alternative investments and building out a diversified multi-asset class portfolio. At this point, a lack of time and/or access to high-quality investment opportunities means that the entrepreneur must either:

- Establish a family office and potentially scale back day-to-day work on their company/companies to focus more on managing their investments. The entrepreneur may feel they must step back to responsibly oversee the capital they have accumulated and ensure it is invested in a way that meets the family and charitable objectives they care most about; or

- Work with an investment advisor, with a clear scope and principles for managing the assets. This frees up the entrepreneur’s time to focus on building their company/companies.

Why the Barbell is riskier than you think

A high allocation to equities – often just a few stocks – complemented by an allocation to low-risk bonds is not an optimal long-term strategy. There is a common misconception that this barbell approach provides safety and preserves wealth. In reality, a sharp decline in equity markets can threaten an entrepreneur’s financial security, while the returns from bonds do not contribute meaningfully to long-term real (inflation-adjusted) growth. Additionally, the barbell model relies on bonds consistently retaining their value (or even performing positively) when stocks decline, a relationship that can – and has in recent years – broken down (e.g., 2022 ; Global Equities: -15.9% and US Municipal Bonds: -6.0%).1

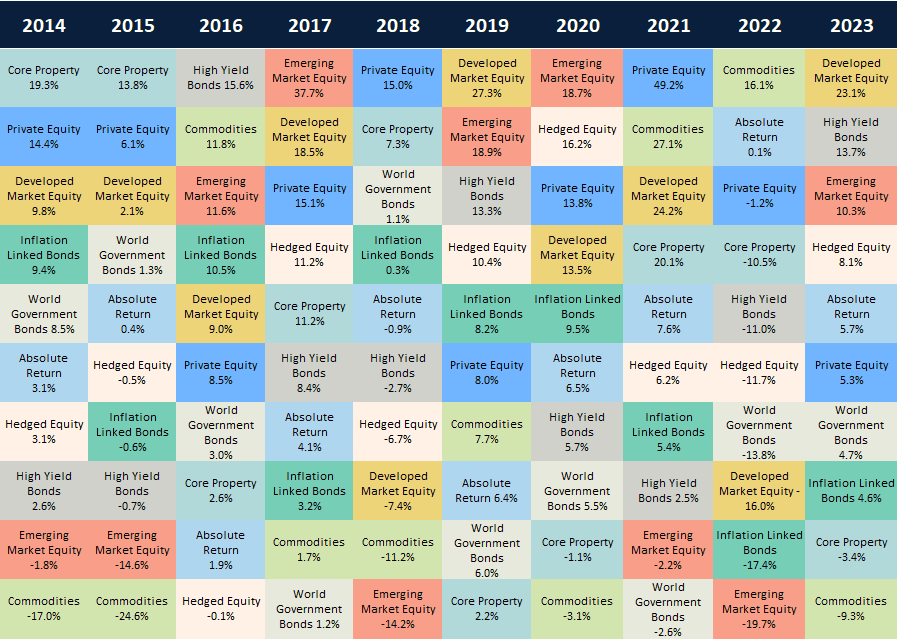

In contrast, exposure to a mix of asset classes can significantly reduce the magnitude of potential drawdowns and volatility of returns, while also increasing overall portfolio growth. Each asset class has a separate role in the portfolio. Figure 1 shows how asset classes perform differently across various market environments, protecting against specific market risks, such as inflation, interest rates, or credit defaults. A multi-asset-class approach creates a more resilient portfolio, lowering volatility and smoothing overall returns.

The appropriate solution for most high-net-worth investors is an actively managed multi-asset-class portfolio invested across public and private asset classes, but only if they have access to the best investment managers.

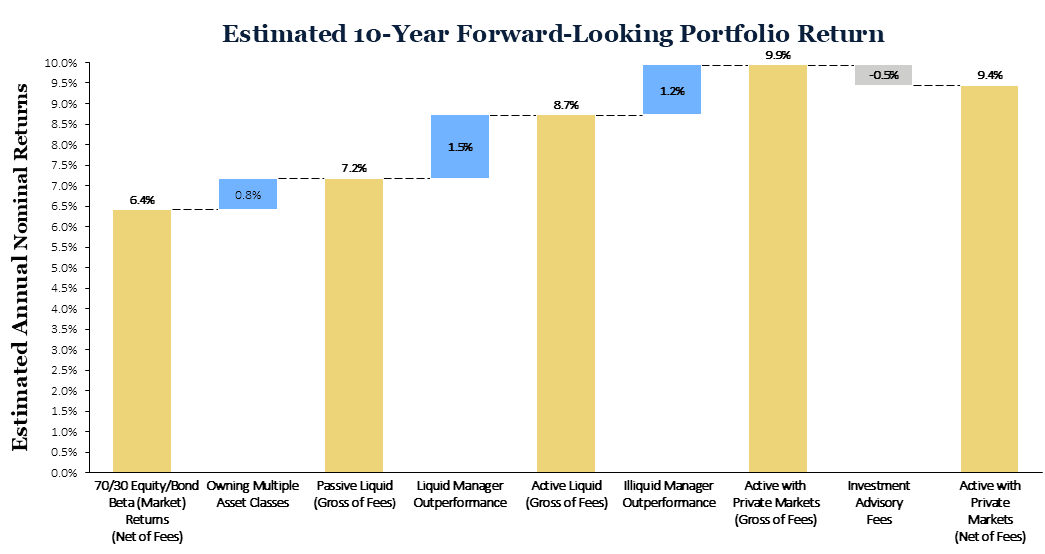

Aside from being more resilient, a multi-asset-class portfolio has a higher estimated return than a risk-equivalent equity/bond portfolio. As shown in in figure 2, once we add the impact of outperformance from active managers, we see a significant increase in expected returns. Nevertheless, Partners Capital estimates that less than 15% of active managers persistently deliver outperformance across asset classes such as absolute return, global equities, and private equity.3 Being able to identify managers that can consistently outperform is critical when choosing an active approach to portfolio management.

Private markets meaningfully enhance returns – but they can be even more difficult to access.

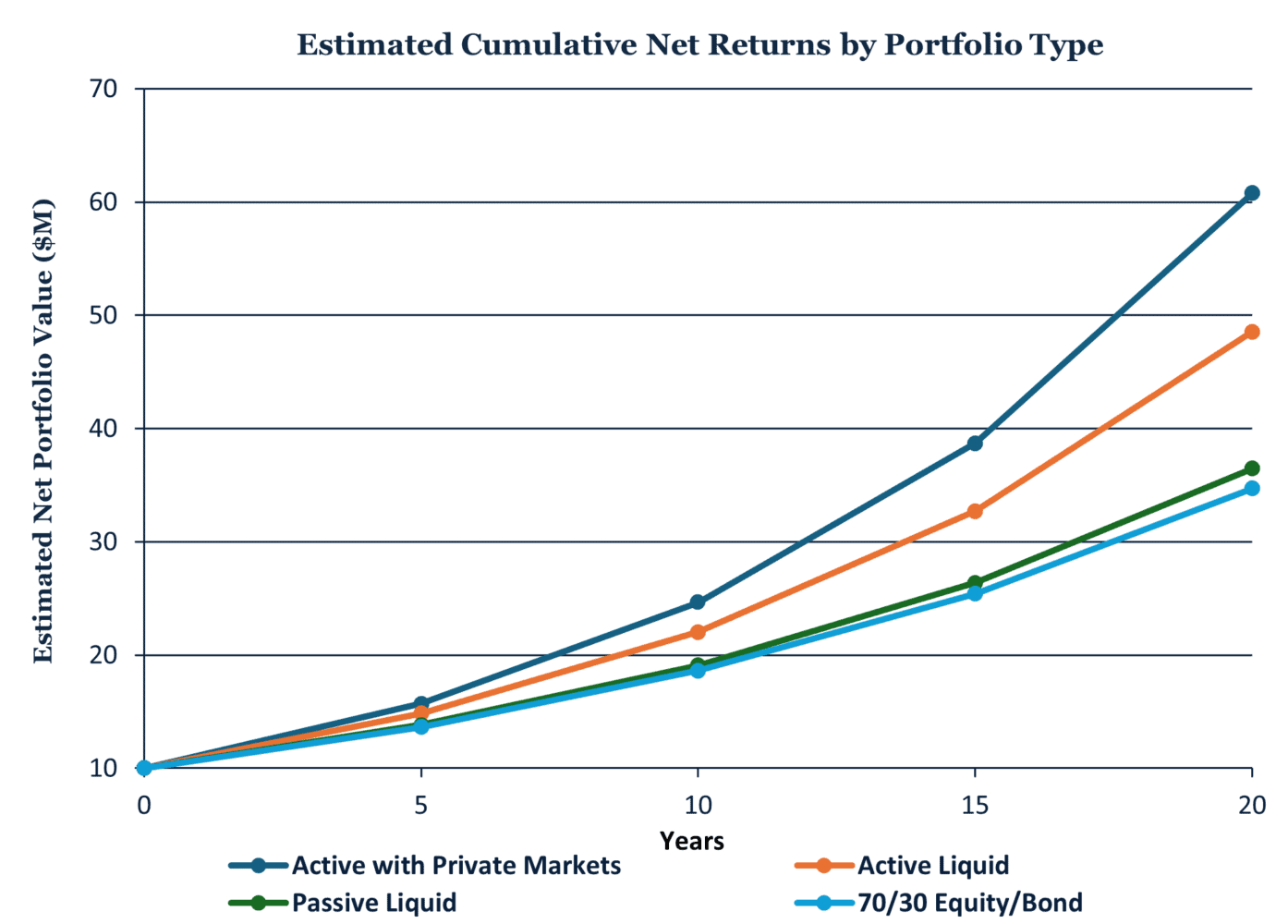

If an individual can tolerate illiquidity, private markets can be a separate source of outperformance and offer a strong risk-adjusted return within a multi-asset-class portfolio. Private markets span several asset classes, including private equity, venture capital, private real estate, private debt, as well as uncorrelated investment strategies, such as litigation finance and drug royalties. These investments are usually illiquid and require a long-term, multi-year commitment. In return, they offer a performance premium for locking up capital. On top of this, there is the potential for additional outperformance from selecting and having access to the top performing managers. Figure 2 breaks out the estimated additional returns that can be realized from incorporating these elements in a portfolio. Over time, the compounding effects can be meaningful, as illustrated in Figure 3.

Figure 2: (1) Owning multiple asset classes, (2) exposure to active management, and (3) Private Markets strategies all contribute to excess returns.4

Hypothetical return expectations are based on simulations with forward looking assumptions, which have inherent limitations. Such forecasts are not a reliable indicator of future performance.

Figure 3: Compounded over time, taking advantage of: (1) multiple asset classes, (2) active management, and (3) Private Markets opportunities can lead to significant wealth growth relative to passive investment strategies.5

The investment program does not exist in a vacuum.

Any customized investment program must take a holistic approach across tax, estate, and cash planning. For entrepreneurs, the liquidity of their investment portfolio needs to be carefully considered in the context of the liquidity (or lack thereof) of their single asset or more concentrated exposures. To that end, cash flow planning and understanding of any liquidity needs in the medium or long term is core to constructing an effective investment program. Additionally, the portfolio should be managed to optimize returns after taxes, generally with a focus on generating long-term capital gains rather than income. Estate planning considerations also come into play – the key is to put the right trust structures in place with appropriate timing over the years. These factors need to be considered together, taking into account each individual’s unique circumstances when developing their investment program.

Partners Capital specializes in constructing customized, multi-asset class portfolios designed to compound wealth while limiting single-asset risk. This approach is particularly well-suited for those who have generated significant personal wealth after a liquidity event.

Footnotes

- Global Equities benchmark is MSCI ACWI NR with DM 100% Hedged to USD Index, Municipal Bonds benchmark is Barclays Municipal Bond 7 Year TR USD Index

- Sources: Absolute Return: HFRI FOF: Conservative Index, Bonds: Barclays 1-5 Year Government / Credit Index, Private Equity: State Street All PE Index (Lagged one quarter), ILB: Barclays Global Inflation Linked TR USD Hedged, Developed Markets Equities: MSCI World NR LC, Emerging markets Equities: MSCI EM (Emerging Markets) TR USD, Hedged Equities: HFRI FOF: Strategic Index TR USD, High Yield Credit: Barclays Global High Yield TR USD Hedged, Real Estate: NCREIF – ODCE Index TR USD, Commodities: Bloomberg Commodity Index TR LC.

- Partners Capital Asset Manager Due Diligence and Selection Criteria Whitepaper

- The information included in this figure reflect Partners Capital internal asset class return assumptions.

- The information included in this figure reflect Partners Capital internal asset class return assumptions, and assumes a 0.50% flat management fee.