Co-Investments-2025

A Leading Co-Investment Partner with Long-Standing Proven Track Record

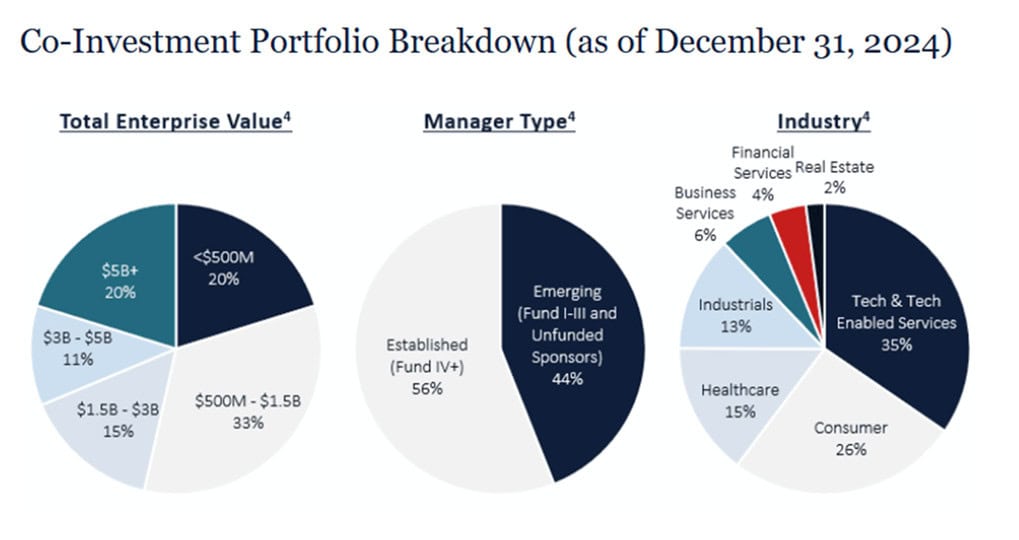

With $2B+1 in private equity co-investment AUM and 70+ deals closed2, Partners Capital brings over 20 years of experience and a differentiated approach, investing alongside what we believe to be the world’s top GPs. Our success is built on a model that is differentiated by deep partnerships, a disciplined selection investment process and proprietary insights.

Partner of Choice for Investors

- Nimble Private Equity Solution – Reduce long-term commitments to narrow sectors, strategies and teams. Co-investment portfolio of assets led by numerous specialist managers allows for nimble selection across changing markets. Lower fee/carry than standard ”2/20.”

- Disciplined Selection Process – Decades of data-driven investment insights to identify what we believe to be the best risk-adjusted opportunities.

- Experienced Team with Direct Investing Orientation – Dedicated team made up of tenured direct private equity investors who are deeply integrated with a well-established fund investing program.

- Portfolio Construction Advantages – Exposure to co-investments via drawdown vehicles for institutional clients, discretionary evergreen vehicles in the US and Europe for ultra-high net worth individuals, separately managed accounts for large family offices, or direct opportunities – we structure programs to fit your requirements.

Partner of Choice for GPs

- Trusted & Agile Capital Partner – Seamless execution, strong GP relationships, and the ability to make firm commitments ahead of an LOI (including ECLs/ESLs) for greater deal certainty. Potential for long-term commitment to GPs via scaled primary funds program.

- Flexible, Scaled Discretionary Capital – $25M-85M check sizes leveraging our $1.5-2.5B in annual fund commitments to those whom we believe to be top-performing managers.

- Comprehensive Investment Focus – Co-investments, continuation vehicles (single and multi-asset), and “mid-life” minority recapitalizations.

Let’s Invest Together

Whether you’re an LP seeking cost-effective private equity exposure or a GP in need of a reliable co-investor at scale, Partners Capital delivers the experience, flexibility, and network to meet your needs.

1. Active platform investments committed to as of 31 December 2024 for which Partners Capital’s co-investment team has full oversight.

Adam Spence

Partner, Head of Co-Investments

”At Partners Capital, we recognize that no two investors are alike—which is why we offer a range of flexible co-investment structures to fit a wide variety of investor mandates. Whether through fully discretionary pooled funds, programmatic frameworks, outsourced co-investment underwriting of existing GP relationships, or hybrid models combining structure with flexibility, we tailor our approach to align with each investor's governance needs, return targets, and sourcing preferences. This flexibility is core to how we help our investors to maximize access to high-conviction opportunities while maintaining control where it matters most.”

Co-Investment Team

Follow our Co-Investment team’s latest updates on our LinkedIn page.