Private Markets

Why Private Markets Investments?

Private markets, including private equity, private debt and real estate, have been able to generate, on average, higher long-term returns than most liquid asset classes.

These returns can be boosted by outperformance from the value that private markets asset managers create through active ownership, leveraging deep sector expertise. The best of the private markets asset managers are able to work with portfolio company management teams to grow earnings faster than we would typically see in public companies.

In stark contrast to public markets, economic incentives can be more easily aligned between company management and investment owners in the private markets, better guiding management to optimize the long-term value of the business rather than focusing on short term quarterly earnings announcements.

For those investors able to commit to investment timelines of ten years or more, history has demonstrated that private market investments can generate higher average returns. However, in today’s rising rate environment, investors can no longer rely on the tail winds of rising public equity prices and on low-cost and covenant light leverage to drive returns.

The continued success of private markets investments will be primarily dependent upon private markets managers enhancing their ability to grow portfolio company earnings faster than incumbent corporate management teams are able to deliver on their own under prior ownership.

Partners Capital brings decades of prior direct and fund investment experience having observed how private markets behave in various stages of the economic cycle, with the firm’s founders having invested in private markets starting in the mid-1980s.

We currently have over $6.5 billion of net asset value invested in private equity, $3.6 billion in private debt and $2.5 billion invested in real estate.1

Our Private Markets Investment Offerings

Our private markets investments include allocations to private equity (including buyouts, growth equity and venture capital), private debt and real estate. Our sustainable investing activities cross all of these asset classes. Similarly, we are actively pursuing low or no-fee co-investments with our asset managers across all private market asset classes.

Private Equity

Buyouts

We are specialists in middle market buyouts, with a bias toward smaller companies who have demonstrated the greatest scope for earnings growth. We believe that the future of private equity is no longer about leverage and multiple expansion but will be crucially dependent upon Post-Acquisition Operating Value Added (“PAOVA”). We have over $6.5 billion1 in net asset value invested in private equity.

Venture Capital and Growth Equity

We have actively invested in venture capital since the beginning of our private equity programme in 2004. In aggregate, we have committed approximately $2 billion to venture capital managers and $1.5 billion to technology-focused growth equity and buyout managers.1

Private Debt

Private debt investing can offer meaningful yield premium and generally better legal and structural protections than liquid credit assets. With the ongoing challenges facing the global banking industry, which started with the 2008 Global Financial Crisis, and which are only being exacerbated in the present banking crisis, direct private lending has become a $1.4 trillion global market. Direct private lending continues to grow in prominence and sophistication as banks continue to retrench. We have $3.6 billion in net asset value invested in private debt.1

Real Estate

Our real estate investing covers all geographic markets and all sectors, including industrial, residential, office, retail, hospitality and other niche sectors. We focus on the “buy, fix, sell” approach, partnering with vertically integrated managers and regionally focused specialist opportunistic funds (or private equity real estate ‘PERE’ funds). We currently have $2.5 billion in NAV invested in real estate.1

Uncorrelated Strategies

Uncorrelated strategies offer returns driven by outcomes that have little or no relationship to financial market movements. We believe this is an important source of returns as we enter a period of higher economic and market volatility. We currently have $600 million in NAV invested in uncorrelated strategies including litigation finance, pharmaceutical royalties and drug trials, life settlements, reinsurance and athlete financing.1

Co-Investments

For scale institutional investors, private markets co-investments have become the primary means through which these firms pass on fee and cost reductions to their largest and most important investors which includes Partners Capital. Forgoing offers of co-investments leaves significant value on the table but requires resources and infrastructure to take full advantage of such discounts. Adverse selection continues to be a significant risk, requiring direct deal due diligence capabilities and deep private markets networks for referencing. Our due diligence focuses on each individual co-investment’s scope for post-acquisition operating value added (PAOVA). It is our observation that few specialist co-investment firms focus sufficiently on underwriting the PAOVA opportunity before approving an investment.

Sustainable Private Investments

Private markets investing provides some of the greatest opportunities for environmental and social impact. We believe that the most attractive investments are in the environmental space and are those that are pivotal to the energy transition. Read our Partners Capital Global Energy Transition Investment Framework whitepaper for an in-depth discussion of where we see the greatest opportunities.

1 As at 31 December 2022

How do we build Private Markets portfolios?

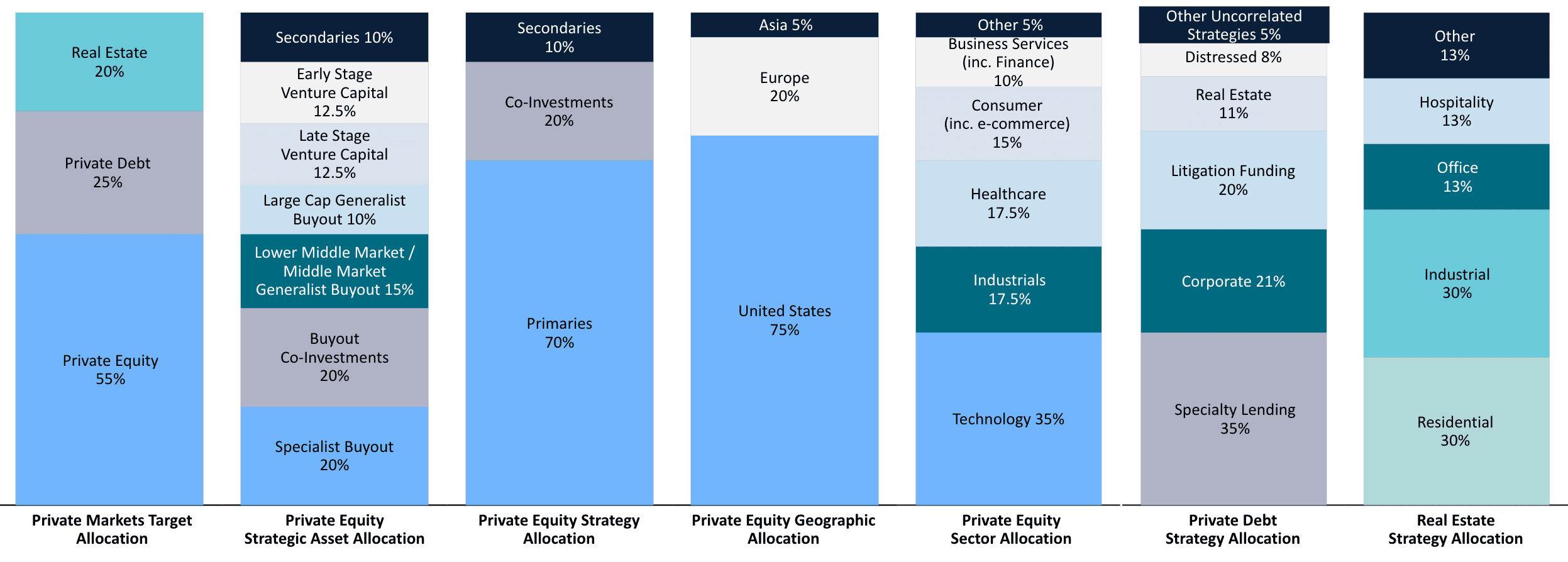

Our private markets portfolios are constructed with defined target allocations across the sub-asset classes, as well as within each sub-asset class. Specific allocation targets are set for geographic, sector, primary vs. secondary private equity and direct private co-investment exposure. We dedicate significant ongoing analysis of the private equity opportunity set across lower middle market buyouts, specialist buyouts, large-cap generalist buyouts, growth equity, early-stage venture and late-stage venture capital and set target allocation ranges based on expected long-term returns, the risks and return correlations for each strategy.

Illustrative $500M Private Markets Portfolio Construction

Actual portfolios will vary by client depending on their non-private markets portfolio, risk appetite, ESG considerations and liquidity constraints amongst other factors.

How do we work with our clients?

We implement private markets portfolios for clients in two ways:

Bespoke Direct Fund Invested Portfolios: These are best suited for investors with the requisite scale, investing directly in underlying funds and co-investments, either held directly or via a “Fund of One” structure.

Pooled Vehicles: These are best suited for clients aiming for operational simplicity and/or those without the required scale to meet the minimum investment thresholds of direct fund investments. We have just closed the 16th vintage of our flagship private markets pooled vehicle, which manages multi-manager portfolios across all subsectors of private equity. We operate similar multi-manager portfolios in private debt, venture capital and co-investments. In 2022 we launched our inaugural private equity environmental impact fund, Partners Capital 15 degrees Fund, LP.

What does Partners Capital bring to your Private Markets Investing?

Tailored Solutions

Each client’s private markets portfolio is customised, taking into consideration their overall portfolio performance and risk objectives, any legacy private markets portfolio and how best to complement the overall portfolio’s exposures.

Team and Network

Partners Capital’s founders have been investing in private equity since the mid-1980s. Many of our shareholders are veteran private equity professionals and a significant proportion of our clients are successful private equity professionals and their family offices. Internally, we recruit investors from the most highly respected firms in the belief that it takes one to know one.

Sourcing and Access

We leverage our deep global private markets investment network to source and gain access to those few firms who we believe to be the leading private markets managers. We partner with managers as a sophisticated LP, with a long-term outlook and with the potential to be value added to their business. This can result in better access to rare manager capacity.

“Sweet Spot” Scale

We are of a sufficiently large size to gain the attention of any private markets firm and to negotiate meaningful fee savings through co-investments, and to seed new emerging managers. But we are not so large as to have to invest primarily with large funds, who may have outgrown their ability to generate outperformance.

Aligned Incentives

Our fees are linked to performance. Every member of our team invests alongside our clients. We provide transparency into our due diligence and prefer to engage with clients in a two-way knowledge sharing partnership.

Full-Service Partner

With an extensive global operations team, we provide private markets clients hands-on support in detailed performance-attribution focused reporting, as well as managing capital calls, distributions, credit lines, currency hedging and cash-flow forecasting. Reporting is highly transparent, and we are keenly focused on delivering returns on your investment in Partners Capital.

Our Private Markets Team

Our broader private markets team of over 30 investment professionals are located across our seven offices, leveraging their local networks across our global footprint.