Investor Perspectives

Reinventing the Endowment Model – taking a dynamic approach to an established classic

2 October 2024

For over 25 years, endowments and foundations have been applying the principles of the endowment model to secure the futures of some of the world’s most prestigious institutions. Thanks to their advocacy of healthy diversification across traditional and alternative assets, many endowments have outperformed over the long-term, but pressure to switch to cheaper, simpler alternatives such as traditional 60/40 equity and bond portfolios is rising given shorter-term performance. In a volatile market environment, can the endowment model still outperform more traditional alternatives?

For more than two decades, Partners Capital has been an investment partner for endowments, foundations, and family offices seeking to build resilient portfolios. With accumulated experience and learning, we have taken this established classic and evolved the model to build our own multi-asset class investment approach, applying the foundational principles of the endowment model and iterating it as capital markets have evolved over time. We call this the Advanced Endowment Approach (AEA). We use the word advanced with a large dose of humility and awareness that this approach can only be effective through continuous improvement in the face of an ever-changing investment landscape.

The Advanced Endowment Approach

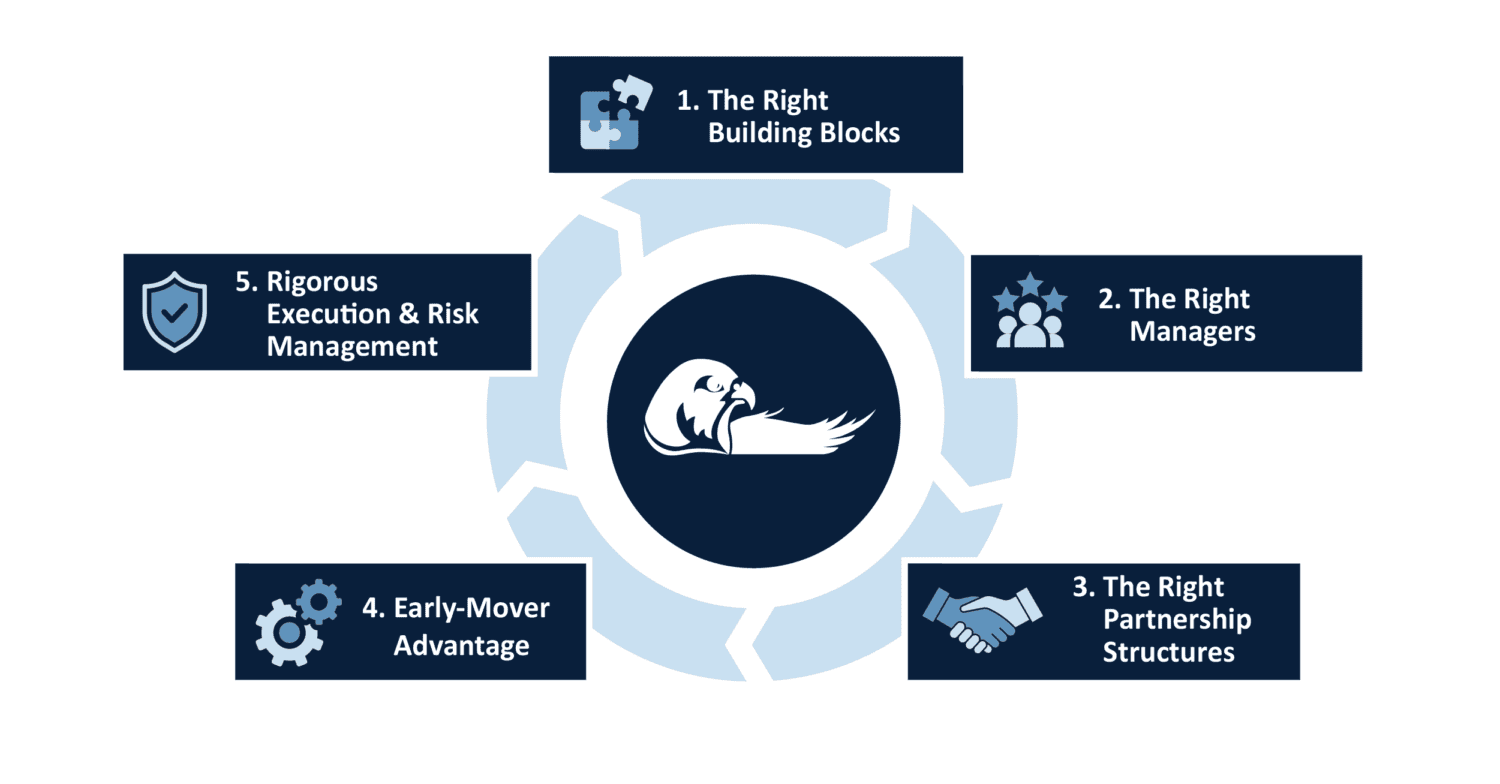

In this article, we outline the key elements of AEA, a streamlined and dynamic multi-asset class approach to endowment-style investing. Like the cogs in a finely crafted machine, each spoke requires precision, knowledge, skill, and – most importantly – ingenuity to build resilience and outperformance.

Five AEA Spokes

- The right portfolio building blocks: most importantly, make the right diversified safety net allocations, tapping into illiquidity premium, and adding sufficient inflation protection.

- The right managers: identify and access managers with true differentiation.

- The right partnership structures: build in value for money. Use scale to negotiate fee discounts, co-investments and customised strategies.

- Early-mover advantage: be ahead of the curve into newer asset classes and investment themes before they become consensus – for example private debt in the early 2010s, litigation financing in 2015.

- Rigorous execution and risk-management: monitor all aspects of risk and rigorously rebalance to a stable risk level to consistently maintain the portfolio’s resilience. Leave no stone unturned when optimising portfolio management costs to generate risk-free return improvements.

Planning for a range of market conditions

Different asset classes are suited to different market environments – while a multi-asset class approach builds resilience in a portfolio whatever the market conditions. This is particularly relevant for endowments and foundations which face a unique set of challenges that must be balanced alongside market issues like inflation and geopolitics while still delivering long-term investment horizons and sustainable returns. As such, the right asset allocation and investment structure are key to these organisations achieving their goals.

The core thesis for adding alternative asset classes beyond traditional equities and bonds is that they can generate returns in environments where one of or both equities and bonds fail. It’s about putting your eggs into several baskets because equity and bond returns are highly dependent on two key uncertain variables (economic growth and interest rates). Historically this has meant the best multi-asset class approaches have outperformed even pure equities portfolios but with lower volatility.

Portfolio Building Blocks

In an unpredictable world, with rising geopolitical tensions, uncertain inflation prospects, an equally uncertain rates and fiscal environment, plus the emerging threats and opportunities from AI, a portfolio approach that caters to multiple scenarios provides more reliable long-term resilience.

Implementing this approach requires the right team of experienced experts and – most importantly – patience. Staying the course is fundamental to performance for any investment approach. In an increasingly uncertain world, organisations already applying this principle should continue to stay the course ensuring the long-term performance results that can be used to continue funding substantial programmes like scholarships, bursaries and the arts.

In the next article in this series, we will outline the first spoke of AEA – putting in place the right building blocks – and explain how this can generate both long-term outperformance while building resilience into a portfolio.