Investor Perspectives

Advancing the Endowment Model

5 August 2024

This is a financial promotion. Your capital is at risk, the value of investments may fall and rise and you may not get back the full amount you invested. Past performance is not indicative of future returns.

The endowment model of investing, which advocates healthy diversification across traditional and alternative assets, has come under fire. At a time when simpler and lower cost public equity and bond portfolios have been delivering strong returns, some critics are questioning whether multi-asset class diversification generates value given its complexity and higher fees.

Yet in a world beset by uncertainty, we believe that investing in a diverse range of carefully chosen opportunities across asset classes remains the most resilient model for long-term portfolios. Implementing this model effectively requires scale, depth of experience in each asset class, adaptability as markets evolve, and a sharp focus on constructing portfolios with a ‘value for money’ approach.

In today’s environment, it is hard to avoid the swirl of headlines around the performance of alternative assets, such as private equity, private credit and hedge funds, that underpin the diversifying approach of the endowment model. So much so that investors may well conclude that they would be better off choosing a more traditional passive 60/40 equity/government bond portfolio, where fees are lower and investment selection more straightforward. However, we would argue that concentrating capital in just two asset classes is risky as there are periods, such as the 1970s and as recently as in 2022, where both equities and bonds saw large losses in real terms.

Indeed, much of the commentary fails to consider the true or complete risk-return characteristics that alternative investments can bring to a well-constructed multi-asset class portfolio. At Partners Capital, we have evolved our own multi-asset class investment approach, applying the foundational principles of the endowment model and iterating it as capital markets evolved over the last 15+ years. We call this the Advanced Endowment Approach (“AEA”). We use the word advanced with a large dose of humility, noting that the approach will only be effective into the future if it continues to evolve in the face of an ever-changing investment landscape.

Parsing through the headlines on Alternatives

Let’s start with the headlines: is there any validity to the criticisms being levelled at private equity, private credit and hedge funds?

Starting with private equity, some question the role of the asset class after it underperformed against the S&P 500 in recent years, with predictions that the ‘golden age’ of private equity is over now that debt costs have risen. While it is true that low interest rates flattered returns in the years running up to 2021, private equity relies on multiple levers to outperform: the three most important ones are valuation multiple expansion (buy low, sell high!), leverage and operating earnings growth. Private equity managers that rely heavily on the first two factors undoubtedly face a much tougher environment to generate outperformance, although of course public equity managers also face these same headwinds. However, private equity managers who derive a substantial portion of their outperformance from helping portfolio companies drive earnings growth are still very much capable of generating premium returns. We expect a private equity portfolio built around managers who can drive operating improvements and maintain strict valuation discipline should continue to outperform public markets by 3% to 5% – a valuable premium for investors1. Co-investments from these managers at heavily discounted fees are an additional lever to boost returns from private equity. However, we note that this additional lever is only available to investors who can deploy a highly disciplined process to access these deals and avoid issues related to adverse selection.

Private credit has faced criticism as capital flowing into the asset class has bid up deal prices leading to fears that the deals don’t compensate investors adequately for the risks assumed. To put capital flows in perspective, private credit today remains a relatively niche part of global lending activity, at $1.5T in assets compared to $140T in overall global fixed income markets. Private credit is also far from a homogeneous asset class and covers a wide range of strategies including classic mid-market corporate lending, real estate-backed financing and specialist capital solutions that provide financing to specific sectors starved of capital at certain points in the cycle. Investors with exposure to the largest, most ‘vanilla’ deals may not achieve excess returns, but those with a carefully chosen portfolio that includes deals off the beaten track across attractive sub-sectors should generate 2% to 4% outperformance relative to traded high yield bonds1.

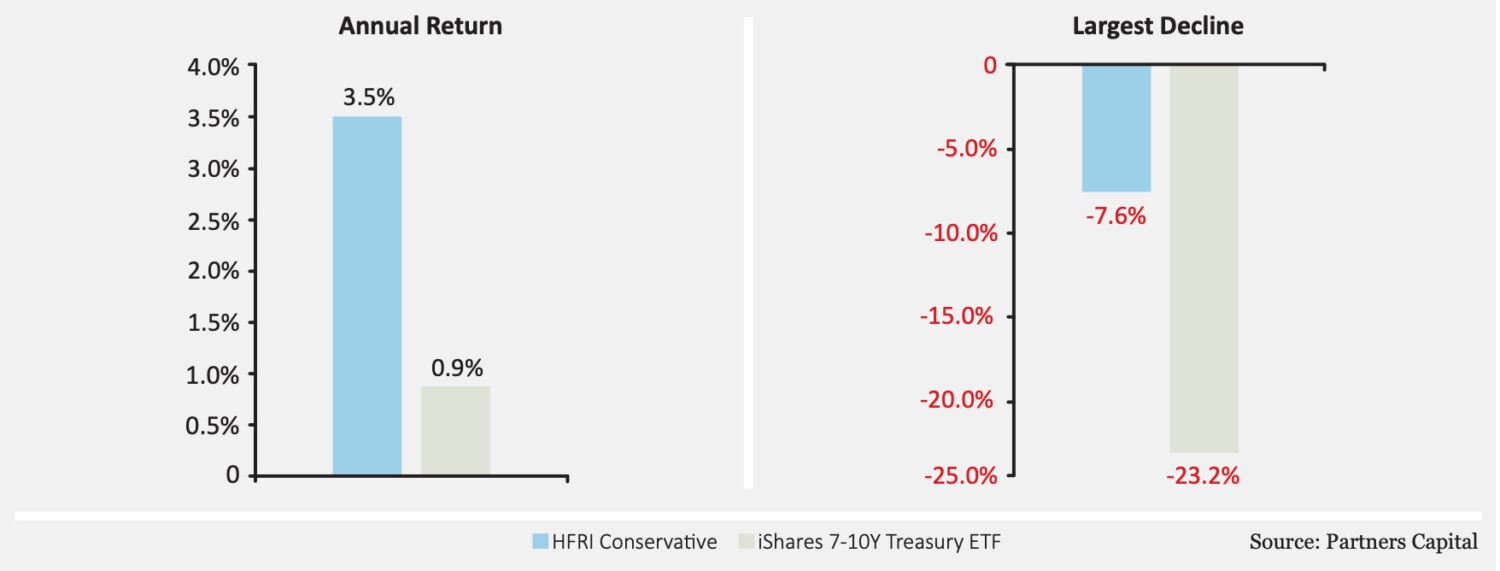

Hedge funds is a catch-all term for a variety of capital market strategies. In many ways, grouping them together as an asset class makes little sense and most media coverage tends to compare hedge fund returns to the performance of equity indices. Yet most hedge fund strategies have different risk characteristics from those of equity market indices. We focus on hedge fund strategies that have limited exposure to equity market indices or other broad macro risks like interest rates and inflation. In our view, a well-constructed portfolio of such hedge funds is best considered as a low-risk alternative to bonds as opposed to equities. This ‘absolute return’ portfolio is likely to offer higher returns and be more resilient than bonds. As shown in Exhibit 1, a broad hedge fund index such as HFRI Conservative Index has outperformed US Treasuries by 2.5% per annum over the last 10 years, while also protecting capital in difficult markets (largest decline was 7.5% in this period versus more than 23% for US Treasuries in the same time period). We would expect well-constructed absolute return portfolios to perform better than broad hedge fund indices, offering 3% to 5% outperformance relative to government bonds1.

Exhibit 1: Annual Return and Largest Decline of HFRI Conservative Index vs US Treasuries Over the Last 10 Years (to 30 June 2024)

Source: Partners Capital

In conclusion, while there are areas within each of the private equity, private credit and hedge fund asset classes that may prove less successful in today’s environment, we believe that there remain significant opportunities in these alternative asset classes that make them compelling for investors.

The resilience of multi-asset class diversification: eggs and baskets

When discussing the role of various asset classes, investment practitioners tend to drive the discussion with terms such as expected returns, volatility, beta and correlations to name a few. But stepping up a level, there is compelling economic logic to the principles of multi-asset class diversification.

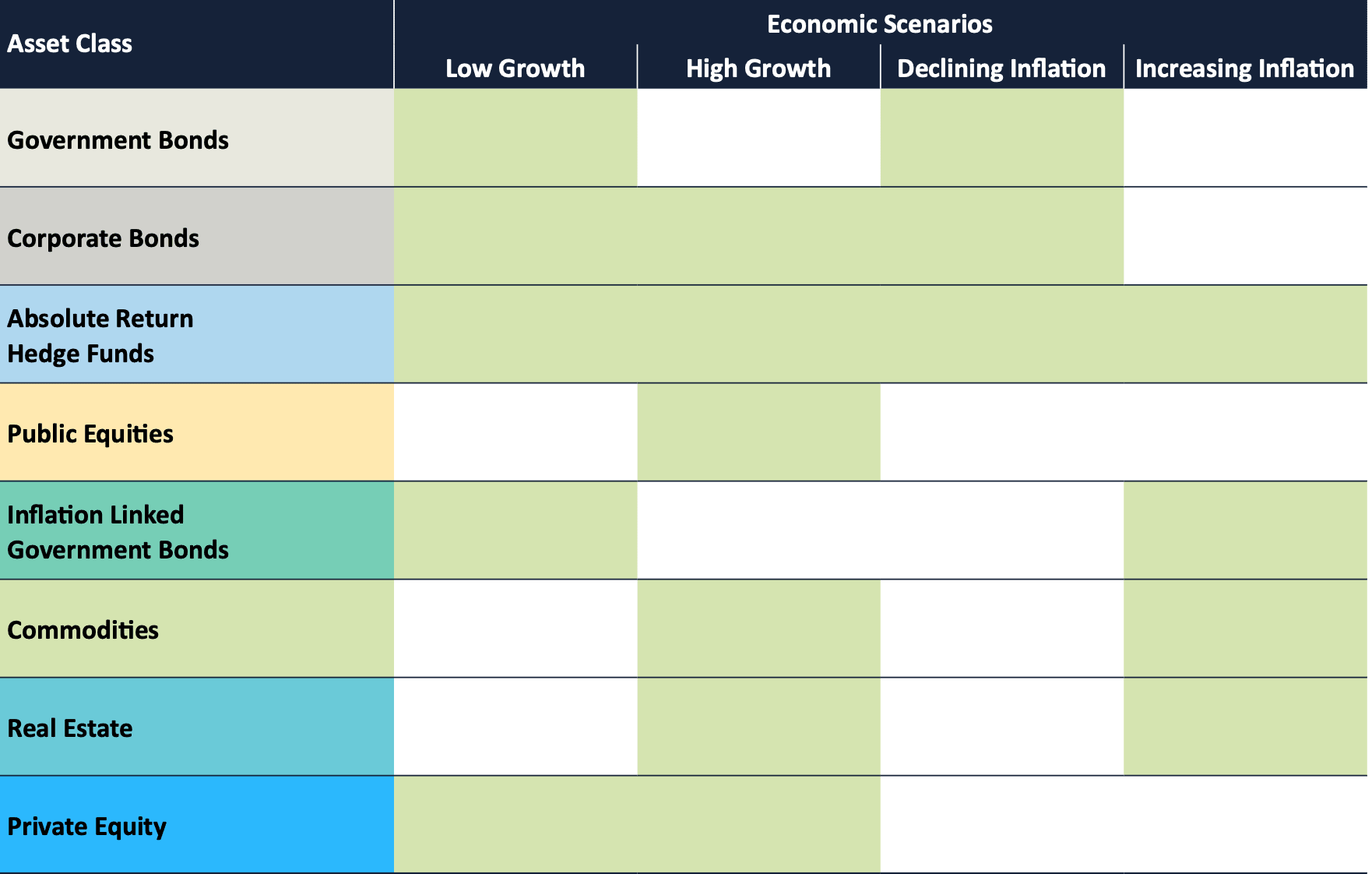

Embracing a broad set of asset classes is simply about putting your eggs into several baskets. This is valuable to investors because the performance of each asset class varies according to the prevailing macroeconomic environment at any given time. In Exhibit 2 below, the shading indicates when each asset class is expected to perform well against the backdrops of low growth, high growth, declining or increasing inflation. Bonds tend to perform relatively better when growth is low and inflation is declining, while equities (public and private) thrive in high-growth environments. Inflation-linked bonds, property and commodities generate stronger returns when inflation is rising or expected to rise. Absolute return hedge funds are relatively agnostic to the macroeconomic backdrop and tend to generate stable returns in most environments.

In an unpredictable world, with rising geopolitical tension, uncertain inflation prospects, an equally uncertain rates and fiscal environment, plus now the emerging threats and opportunities from AI, a portfolio approach that caters to multiple scenarios provides more reliable long-term resilience.

Exhibit 2: The core thesis underpinning multi-asset class diversification is that it hedges against different economic scenarios, which explains why their returns are not highly correlated.

Source: Partners Capital.

Note: Shaded cell indicates asset class performance is likely to be strong in that economic environment.

Easier said than done

While there are cheap and easy ways to invest in a traditional equity/bond portfolio, accessing alternative asset classes requires paying higher fees, accepting some level of illiquidity, and being comfortable with a lack of day-to-day transparency on investments. As a result, deploying a diversified multi-asset class approach is easier said than done.

Architect of the endowment model, David Swensen, famously said: “Almost everybody belongs on the passive end of the continuum. Very few belong on the active end.”

Swensen made this statement more than 20 years ago because investing in alternative asset classes requires paying high fees. Finding the few that outperform net of all fees is not easy. Since he made this statement, investments in alternative asset classes have ballooned with nearly $22T or 15% of global capital invested in these asset classes.

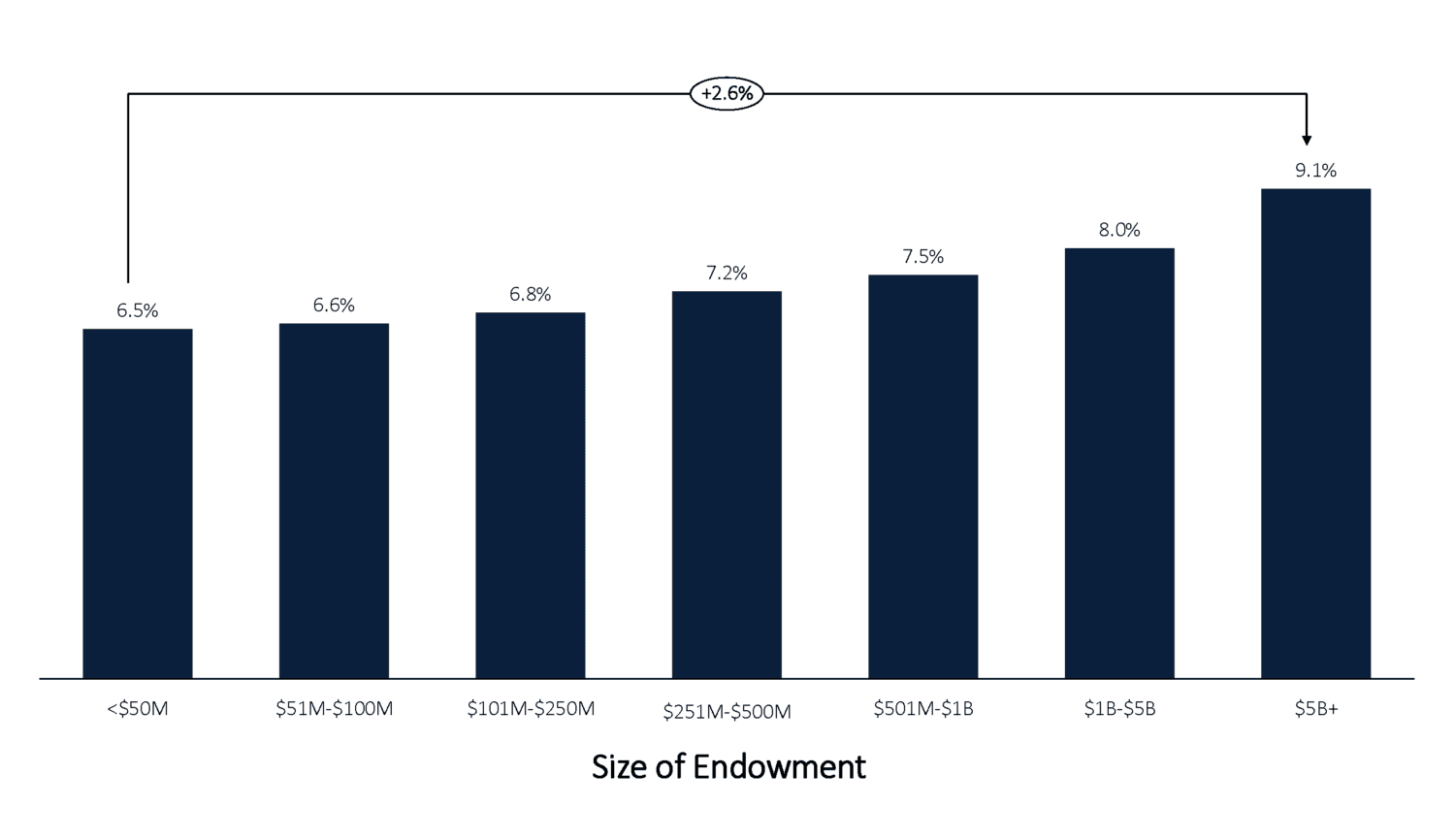

With so much choice available, how do investors know where to look? Unsurprisingly, the solution is depth of research and experience. According to the NACUBO-Commonfund Study of Endowments, there is a clear correlation between size and performance, (see Exhibit 3). Smaller endowments have lagged the largest by 2.5% a year over the last 10 years. As this data suggests, modest portfolios managed by small internal teams based in a single location may struggle to adopt a true endowment model of investing that has an appropriate allocation, and is able to gain access, to high-quality managers in alternative asset classes. Without sufficient scale, investors seeking to build a more resilient multi-asset class portfolio should partner with organisations that have the expertise, scale and alignment of incentives necessary to execute this approach successfully.

Exhibit 3: Endowment Performance by Size (periods ending 30 June 2023)

Source: NACUBO-Commonfund Study of Endowments²

An important pre-requisite for successfully implementing this approach is to ‘stay the course’. Just like a broken clock is right twice a day, simpler approaches to investing will seem appealing at certain points in time. This often leads to abandoning the more complex endowment approach at precisely the wrong time. This risk is perhaps most important for investors to guard against.

The Five Spokes of the Advanced Endowment Approach (AEA)

For more than two decades, Partners Capital has acted as an investment partner for endowments, foundations, and family offices seeking to build resilient and robust portfolios. Through accumulated experience and learning, we have evolved our own multi-asset class investment approach, applying the foundational principles of the endowment model and iterating it as capital markets evolved over time.

We call this the Advanced Endowment Approach (AEA) and set out the five underpinning spokes below:

- The right portfolio building blocks: most importantly, the right diversified safety net allocations, tapping into illiquidity premium, and adding sufficient inflation protection.

- The right managers: identify and access those that have true differentiation.

- The right partnership structures with a ‘value for money mindset’: scale is our friend in getting fee discounts, co-investments and customised strategies.

- Early-mover advantage: being ahead of the curve into newer asset classes and investment themes before they become consensus – e.g., private debt in early 2010s, litigation financing in 2015.

- Exceptional execution and risk-management: monitor all aspects of risk and rigorously rebalance to a stable risk level to consistently maintain the portfolio’s resilience. Leave no stone unturned when optimising portfolio management costs as this is risk-free return.

Where to next?

The endowment model is as relevant today as it ever was, with a track record that continues to deliver impressive results for many institutions. Yet we don’t see the Advanced Endowment Approach (AEA), which is based on the original endowment model, as set in stone. Over the 23 years that Partners Capital has been in business, we have continuously adapted, refined and innovated our approach according to our clients’ needs and the changing economic environment. The market and investor requirements will continue to shift over time and while the endowment model forms the bedrock for our thinking, we will continue to learn and iterate to deliver the best possible results for our clients.

- Hypothetical return expectations are based on simulations with forward looking assumptions, which have inherent imitations. Such forecasts are not a reliable indicator of future performance.

- https://www.nacubo.org/Research/2023/Public-NCSE-Tables