Investor Perspectives

ESG and Impact Investing: A Roadmap to an Evolving Frontier Webinar Executive Summary

13 October 2020

Agenda

| Presenter | Topic |

|---|---|

| Arjun Raghavan Chief Executive Officer |

Introduction |

| Stan Miranda Chairman and Founder |

Introduction to ESG and Impact Investing |

| Sir Ronald Cohen Co-Founder Chair, Global Steering Group for Impact Investment |

Impact Investing: Risk, Return and Impact |

| Euan Finlay Partner, Head of Responsible Investing |

Pitfalls of ESG and Impact Investing |

| Stan Miranda Chairman and Founder |

Partners Capital ESG and Impact Investing Framework |

| David Blood Co-Founder and Senior Partner, Generation Investment Management |

Linkage between ESG and Financial Performance |

| Q & A | |

| Alex Band Partner, Head of Public Equities |

ESG and Impact Investing in Public Equities |

| Suzanne Streeter Partner, Head of Private Markets |

ESG and Impact Investing in Private Equities |

| Close and Q & A | |

Introduction

Arjun Raghavan, Chief Executive Officer

Three years ago, we wrote that environmental, social and governance (ESG) and impact investing had reached a tipping point, driven by policymakers, institutional capital and broader society becoming increasingly focused on the major challenges impacting humanity and our planet. Three years on, ESG and impact investing has firmly emerged as a megatrend. There is an estimated $31 trillion in professionally managed assets which adhere to a responsible investment strategy and that figure is only expected to grow. This megatrend will disrupt industries and create winners and losers. Understanding how to invest in this context was the central purpose of this webinar.

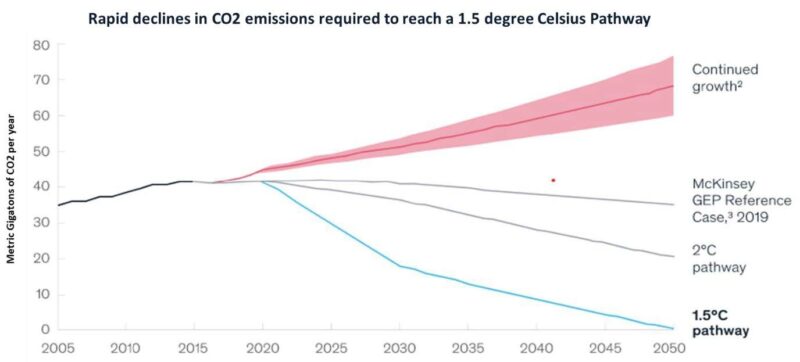

Recognising the implications of global warming, the international community agreed to limit global temperature increases this century to 1.5 degrees Celsius under the 2015 Paris Agreement. However, this will require rapid declines in CO2 emissions from current levels to reach this goal as shown in the chart below. This will require profound changes both to the production and consumption of energy with far-reaching consequences for different economies and industries.

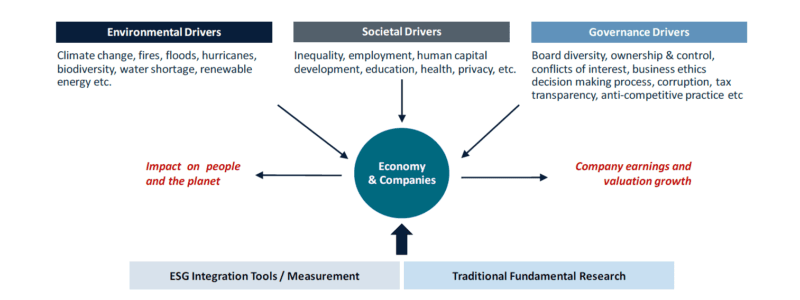

While this illustrates how important environmental drivers are becoming as a determinant of the success of a company, social and governance issues are also gaining prominence. Accordingly, the explicit inclusion of such ESG factors in assessing a company is also likely to become ever more important. This explicit inclusion of such ESG factors, as an adjunct to “traditional” fundamental analysis, in an investment process is the definition of ESG investing. The inclusion of ESG factors is to complement, not replace, traditional fundamental analysis (as illustrated in the chart below).

Impact investing is a subset of the broad ESG umbrella that goes one step further; capital is invested specifically in those companies which are considered to be contributing to desired positive environmental or social outcomes alongside a financial return.

Introduction to ESG and Impact Investing

Stan Miranda, Chairman and Founder

Of the approximately $270T of investable assets in the world today, $31T is estimated to be invested with some level of ESG or impact focus, having grown from $14T in 2012. Despite this impressive growth, Partners Capital has been measured in its approach to ESG and impact investing, recognising the challenges which range from the fundamental definitions used within the sector to ESG and impact measurement and linkages with financial performance.

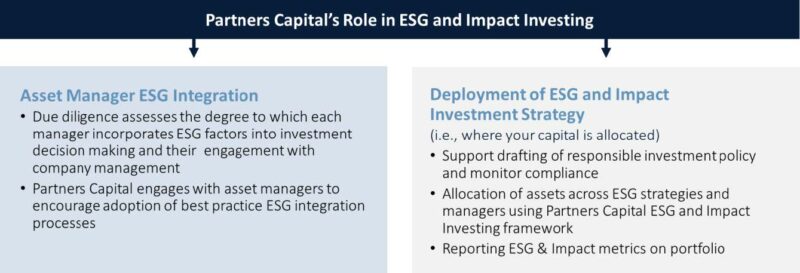

With those challenges as context, Partners Capital have a dual role;

- due diligence of asset managers to assess the extent to which each manager is incorporating ESG factors into the investment process. We have created a proprietary survey and scoring mechanism which allows managers to be ranked against their cohort. Having done this for many years, we believe we understand the policies and practices that constitute best practice across asset classes, knowledge that we use to engage with those managers that have room to improve. Ultimately, our focus is improving the scores each year; either because the incumbent managers are improving (which can be following engagement by Partners Capital) or we are upgrading managers.

- deployment of an ESG and Impact Investing Strategy. Quite simply, where our clients’ portfolios are invested. This includes helping clients codify a responsible investment policy uniquely suited to them, recommending ESG strategies and managers to fit this policy, and reporting on ESG and impact metrics of the portfolio.

Partners Capital’s illustrate the link between impact, measurement and financial performance via a “virtuous circle”. This theory starts with effective ESG or Impact measurement which allows investors to assess the impact of a company on populations and the planet. Company management adapts its behaviour and operations to increase impact given the fact that they are now assessed on these outcomes, contributing to improved environmental and social outcomes. Companies with the greatest impact should be able to attract more customers, better talent and investor inflows, benefitting the company’s earnings and share price performance.

Partners Capital’s illustrate the link between impact, measurement and financial performance via a “virtuous circle”. This theory starts with effective ESG or Impact measurement which allows investors to assess the impact of a company on populations and the planet. Company management adapts its behaviour and operations to increase impact given the fact that they are now assessed on these outcomes, contributing to improved environmental and social outcomes. Companies with the greatest impact should be able to attract more customers, better talent and investor inflows, benefitting the company’s earnings and share price performance.

Impact Investing: Risk, Return and Impact

Sir Ronald Cohen, Co-Founder Chair, Global Steering Group for Impact Investment

Sir Ronald Cohen is Chairman of the Global Steering Group for Impact Investment and The Portland Trust. He is a co-founder of Apax Partners, Social Finance UK, USA, and Israel, and co-founder Chair of Bridges Fund Management and Big Society Capital. He co-founded and was Executive Chairman of Apax Partners (1972-2005). He was a founder director and Chairman of the British Venture Capital Association and a founder director of the European Venture Capital Association.

Sir Ronald Cohen is Chairman of the Global Steering Group for Impact Investment and The Portland Trust. He is a co-founder of Apax Partners, Social Finance UK, USA, and Israel, and co-founder Chair of Bridges Fund Management and Big Society Capital. He co-founded and was Executive Chairman of Apax Partners (1972-2005). He was a founder director and Chairman of the British Venture Capital Association and a founder director of the European Venture Capital Association.

Innovations in the investment industry can transform the way portfolios are constructed. The introduction of the measurement of investment risk allowed investors to assess risk adjusted returns (rather than purely return), paving the way for investment portfolios to transform from a simple mix of stocks and bonds to a diversified mix of asset classes. A similar transformation could be underway today which will ultimately lead to investments being assessed subject to three metrics; risk, return and impact.

However, full adoption will require the standardised measurement and reporting of impact. Drawing the analogy of financial reporting before the great depression, prior to 1933, companies were able to report their financial statements subject to a patchwork of inconsistent standards. In 1933, the US government mandated that all companies must follow generally accepted accounting principles for financial reporting in order to improve consistency and comparability across companies ultimately, leading to the explosion in equity financing for companies. A standardised approach to accounting for impact is also required.

Progress on this front is encouraging, most notably, the Impact-Weighted Accounts Initiative at Harvard Business School which aims to quantify a company’s social and environmental impact in US dollars terms. This allows the company’s real-world impact to be compared against financial performance. To date, the initiative has focused on quantifying environmental impact, which it has calculated for c.1,800 companies. The initial results are striking. They found that 252 companies (or 15% of the dataset) cause more environmental damage than they create in profits, while a further 543 firms (32%) would see their profits reduced by 25% after accounting for environmental impact. The initiative is now focused on similar calculations for product and employment impact, thus providing a more holistic understanding of the impact of each company.

Impact transparency would have far-reaching consequences for companies, governments and investors. First, governments will be able to tax companies directly for the harm they cause while creating incentives for companies to deliver positive impact. Second, investors will be able to price the environmental and social impact of companies into their investment analysis, potentially leading them to shun those causing the largest negative impact in favour of those generating positive impact. Finally, these trends should catalyse a change in corporate behaviour to better manage their environmental and social impact, in addition to just their financial profitability.

Pitfalls of ESG and Impact Investing

Euan Finlay, Partner, Head of Responsible Investment

As with any sector that has evolved as rapidly as ESG and impact, several pitfalls have opened which investors need to understand as context for the creation of a responsible investment strategy. These include ESG measurement, greenwashing and the flood of capital which could detrimentally impact returns.

1. ESG Measurement

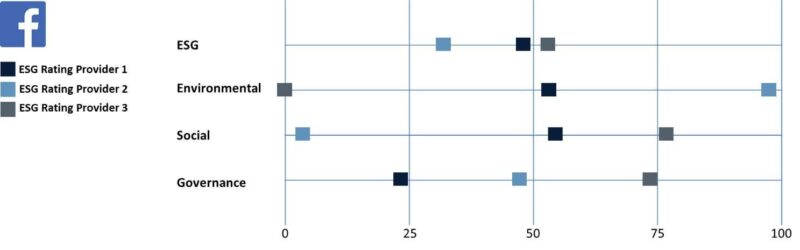

A large and growing industry of third-party ESG data providers has evolved in recent years, focused on the production of ESG scores for companies. This group includes the usual suspects from the large financial data providers (such as MSCI and S&P), dedicated ESG-focused data providers (such as Sustainalytics and TruCost) and underlying asset managers who have created their own metrics. However, a key challenge for investors has been the contrary conclusions these providers come to on each company. This stems from the use of different underlying datasets, each provider’s differing views on the financial materiality of ESG issues, and differing views on what constitutes a “good” outcome. To illustrate this dispersion, shown below are the ESG scores for Facebook from three of the well-known third-party ESG data providers.

In addition to the lack of consensus between providers, there are other measurement issues for investors to contend with. ESG scores are often partially based on what we term as “inputs” rather than “outputs”; for example, whether a company has a policy on a particular issue rather than the hard data that would prove success on that issue. Inconsistent data disclosure from underlying companies can result in some companies being scored based on “models”. Finally, it can be difficult to compare ESG scores between companies, and even more difficult to relate a score to tangible real-world impact.

Accordingly, we believe the next frontier in measurement will be impact-weighted accounts. By measuring the impact of companies, impact-weighted accounts will shift the focus to “outputs” rather than “inputs”, and expressing this impact as a dollar figure will allow comparison across companies and, importantly, can be compared to financial performance. Successful adoption will rely on companies producing consistent and reliable data and we believe regulation will have a role to play in aiding this transition.

2. Greenwashing

Ambiguity on ESG measurement creates a conducive backdrop for the second pitfall, greenwashing. We define greenwashing as the misleading or unsubstantiated marketing in which companies are presented as being more environmentally sound than reality.

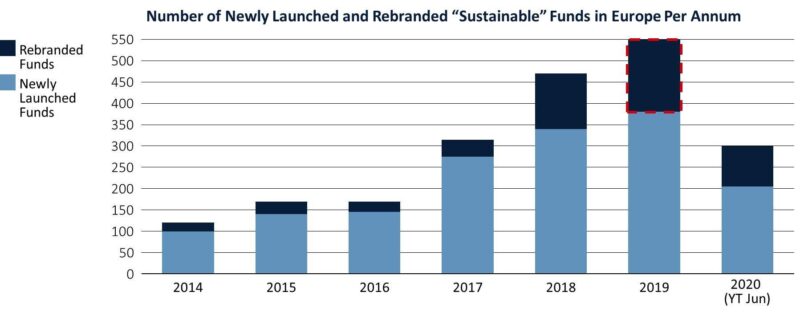

Given the growing interest in ESG and impact investments, the incentive for asset managers to present products as having greater impact than reality has increased. According to data from Morningstar shown below, over 150 funds in Europe alone were rebranded from their prior strategy to being “sustainable” in 2019. While we are sure that a proportion of these funds have significantly changed their strategy from the prior offering to integrate ESG considerations into the investment decision making, it does make one question whether that it true in all cases.

Despite the likely variability of the degree of ESG integration between these funds, there were still 550 new funds purporting to be sustainable launched in 2019, which highlights the potential for the final pitfall.

3. Flood of Capital

History is littered with examples of capital flooding into sectors expected to benefit from a tailwind, driving up entry prices while ignoring fundamental business principles.

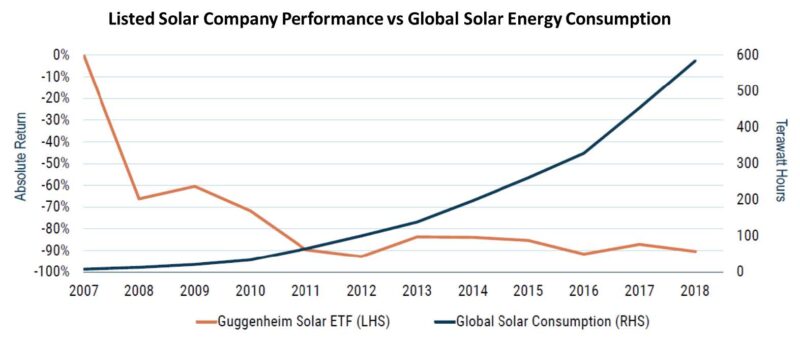

The history of financial returns in listed solar energy companies perfectly illustrates this risk. Despite the increasing usage of solar-powered energy production, the share prices of listed solar companies suffered dramatic declines in value as shown in the chart below. This was ultimately due to 1) the flow of capital initially inflating the share prices of these companies; 2) limited barriers to entry which led to the rapid arrival of new entrants; 3) technological innovation making the cost of manufacturing and running solar panels cheaper; and 4) increased Chinese production of more cost-competitive solar panels flooding the market.

Partners Capital ESG and Impact Investing Framework

Stan Miranda, Chairman and Founder

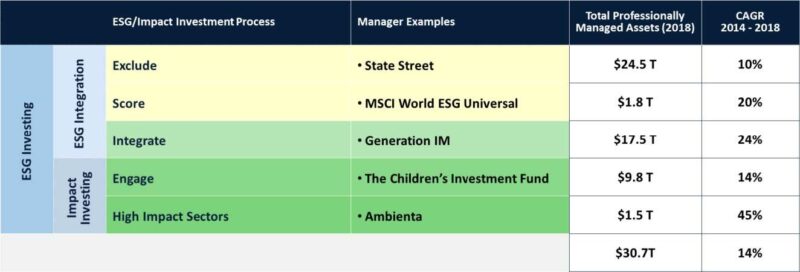

We have identified five broad categories of approaches, three of which are what we refer to as ESG integration strategies while two are more focused on generating impact. These are laid out below in the order of the impact we believe they can have.

1. Exclusion

This involves the exclusion of specific sectors, geographies or companies, with typical examples of exclusions being tobacco and fossil fuels. A common question we are asked is whether there is a negative impact on performance from excluding certain sectors. While exclusions can have a meaningful impact on performance over shorter timeframes, there is evidence to suggest that over the very long-term exclusions have minimal impact on performance.

2. Scoring

This encompasses strategies that seek to skew a portfolio on the basis of the ESG scores for the underlying companies. This could be a strategy which skews the portfolio to the highest scoring companies or to those companies with the greatest scope for improvement if the investor believes it will be successfully delivered. It is worth noting that such strategies often also have exclusions in place. While we believe such approaches have the scope to have greater impact than pure exclusionary strategies, we have not seen compelling evidence to suggest scoring strategies outperform, while also noting the challenges associated with ESG measurement highlighted above.

3. Integration

The explicit inclusion of financially material environmental, social and governance factors into investment analysis. This is ultimately a lens to help the investor make better-informed and more holistic decisions about the quality of and prospects for the company. Many are attempting to execute this strategy, but few have demonstrated tangible outperformance.

4. Engagement

Engagement with corporate management, boards and other shareholders to influence company behaviour on specific ESG issues such as environmental disclosure, diversity of the workforce and executive pay. While there is a spectrum of the level of engagement by investors, we classify engagement as impact given the profound changes to management behaviour that can be enacted through engagement by large shareholders.

5. High Impact Sectors

Perhaps the strategy expected to have the greatest impact involves specifically targeting investments in what we classify as “high impact sectors”. Examples of such sectors include life sciences, FinTech, education and environmentally focused strategies.

Of the five different ESG and impact investing strategies, the largest is still exclusions although with all others growing at a quicker rate. ESG integration is perhaps the most treacherous for investors to navigate, with its abundance of products and high dispersion in quality. We have learnt that only a handful of firms have shown consistent outperformance having adopted this approach, one of which is Generation Investment Management.

Linkage between ESG and Financial Performance

David Blood, Co-Founder and Senior Partner, Generation Investment Management

David Blood is co-founder and Senior Partner of Generation Investment Management. Since its founding in 2004, Generation has played an integral role in the development of sustainable investing and in demonstrating the long-term commercial and societal benefits of this approach. Previously, David spent 18 years at Goldman Sachs including serving as CEO of Goldman Sachs Asset Management. He is chairman of Dialight, Social Finance UK and co-chair of The World Resources Institute and on the board of On the Edge Conservation.

Since Generation Investment Management’s founding 17, they have commonly encountered the notion that incorporating sustainability issues into an investment process means “trading values for value” or accepting concessionary returns. Generation strongly disagrees. Instead, ignoring sustainability would result in less well-developed understanding of their companies and would be detrimental to financial returns.

Further reinforcing this view are the three key beliefs underpinning Generation’s investment strategy since inception. Firstly, that long-term investing is best practice, especially in the realm of ESG and impact investing. Secondly, long-term sustainability issues are key drivers of economies. Therefore, it is imperative for investors to understand and incorporate these drivers for better investment outcomes. Finally, in order to succeed in something as competitive as investing, you need to be as rigorous and holistic as possible. As such, assessing sustainability and ESG issues should be viewed as one tool within a traditional investment process.

Generation Investment Management have the following four observations about investing in the current environment.

- ESG and impact investing should be thought of simply as investing, rather than an expression of values.

- The sustainability issues Generation seeks to understand and incorporate are becoming more relevant today, not less, and are increasingly interlinked. Chief among these drivers is climate change which will be the single largest driver of change in the next decades. Investors cannot afford to ignore its potential impact.

- Incorporating sustainability issues is not just about risk; these structural shifts create opportunities for companies and sectors that investors should look to take advantage of.

- All investing has impact. All businesses have impact. As measurement improves, evaluating investment opportunities based on their expected impact will become as important as evaluating expected return.

ESG and Impact Investing in Public Equities

Alex Band, Partner, Head of Public Equities

Our public equity investment program follows the same ESG and Impact investing framework described above. We generally eschew exclusions, as it has minimal impact and alpha, and it can preclude constructive engagement with companies. While we do see a role for scoring strategies, we are aware of the limitations associated with ESG scores today and limit our focus to passive scoring strategies. Integration and engagement represent core allocations within our portfolios. The methods of implementation are key however; integration can range from a “check-the-box” approach to ESG issues to true, deep consideration of these factors in investment decisions. Engagement can range from simply voting shares to intensive board and CEO-level pressure. We invest in high impact sectors selectively, where an ESG lens is critical to investment success in a disruptive industry. We have been investors in life sciences at scale since 2015 and screening the universe of environmentally focused impact managers. However, we are aware from historical industry disappointments that the business case must be as strong as the impact case.

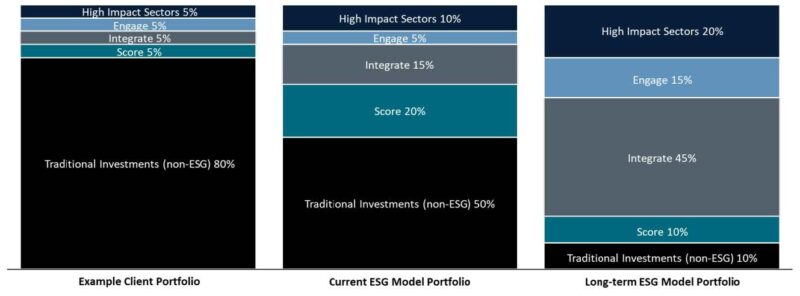

The chart below illustrates how we expect our allocations to ESG and impact investing strategies to evolve. The left-hand bar is a client example today, the middle bar is our “ESG public equity model portfolio” today and the right-hand bar shows our longer-term model portfolio. Scoring plays a meaningful role today but declines over time given its low expected impact and alpha. Integration is expected to grow considerably, as we deploy capital to new managers with well-developed ESG integration strategies and as existing managers increase adoption of best practices. Engagement is also expected to grow through the same levers. The allocation to high impact sectors is expected to increase but more modestly as we add environmental sustainability strategies to our existing life sciences line-up.

ESG and Impact Investing in Private Equity

Suzanne Streeter, Partner, Head of Private Markets

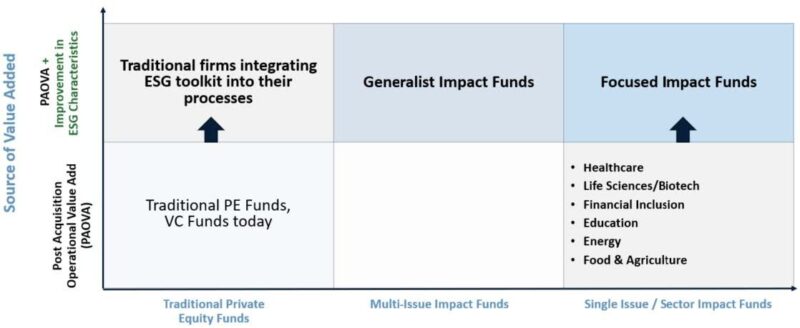

We believe ESG integration and high impact sectors are the relevant categories to focus on within private equity. To segment our private equity investment opportunities, we firstly make a distinction between value-added from traditional post-acquisition engagement with management teams on cost reduction, margin enhancement, international expansion, etc. and those which also aim to enhance ESG characteristics of companies. This is the Y-axis on the chart below.

The X-axis distinguishes between generalist funds on the left to those focused on multiple impact issues and, on the far right, those focused on a single impact issue. This chart is useful in explaining the pattern of PE firm behaviour around ESG investing. Firms are moving from lower left to the upper left by adding the ESG toolkit to their strategy. Funds like TPG are launching funds focused on those same capabilities but applied to companies in high impact sectors. Finally, specialist firms like Ara are taking their expertise in energy and launching alternative or renewable energy investment strategies.

The sub-sectors targeted within our environmental impact strategy have been informed by the history of “clean tech” investments over the last 20 years which was discussed in detail, including the scale of invested capital and performance of each sub-sector. While clean tech investments have disappointed, generating a 6% gross IRR since 2000, this has been driven predominately by Renewable Power Manufacturing businesses which suffered a negative -10% IRR which implies many complete write-offs. With this context, we have screened over 400 impact investment funds down to a short list of 20 based on team quality, experience and deep domain knowledge about narrow sectors. Many teams have only recently come together and offer limited track records of investing in this space, while a good majority are also subscale and therefore could struggle to attract the right talent.

Summary Comments

Arjun Raghavan, Chief Executive Officer

- Environmental, societal and governance issues are significant macro drivers impacting companies and economies

- ESG integration is a tool kit to assist investors make better informed decisions about the quality of a company

- Impact investing is targeting investments in those companies whose products / services are having a measurable positive contribution to people or the planet

- There is a significant flow of capital towards these investment strategies

- There are many pitfalls associated with these strategies, including, measurement, greenwashing, and the flood of capital. Care needs to be taken to avoid a repeat of clean tech v1.0

- Partners Capital’s role is to 1) assess the ESG integration of asset managers; 2) construct portfolios for clients with those strategies at the intersection of return and positive impact on the planet or people

- We believe we have created a framework which will assist clients in navigating this evolving frontier

- ESG and impact investing is not a silver bullet for performance – outperformance will continue to be driven by extraordinary asset managers with the deepest insights of the multi-faceted drivers of companies / securities’ valuation