Whitepaper

Technology’s Impact on Active Investing

By Stan Miranda

1 January 2018

Big Data, or the growing universe of information traversing the web, that is available to systematic and fundamental active managers is changing the competitive landscape favouring those firms best able to find and process such data into powerful investment insights. We expect the greatest alpha generation in the future to come from those fundamental managers who are using technology most effectively to evolve toward the hybrid ‘human + machine’ investor.

Technology is disrupting most industries today. Active investing is no exception. The most important changes that are shaping the industry are: increased processing power enhanced by cloud computing and low cost memory, an explosion in the types and quantum of data and advances in machine learning and artificial intelligence.

The growth of the smart beta industry has already put many ‘discretionary’ managers out of business and represents just the tip of the iceberg. As ‘alternative data’ is collected, from social media, web searches, transaction data, satellite imaging and other sensors, and analysed using advanced algorithms, all but the longest horizon discretionary investor are under threat in the next decade.

At the highest level, ‘alpha’ is derived from one or more of the following three sources: 1) speed advantage, 2) information advantage, or 3) analytical advantage. Technology has already fully disrupted the speed advantages that discretionary managers historically enjoyed and their information and analytical advantage will be increasingly challenged by progressive systematic investors exploiting more data and processing power.

The most vulnerable are opportunistic discretionary managers trading with sub one-year horizons based on quantitative technical information and fundamentals; as systematic firms exploit superior predictive data to outmanoeuvre humans. The least vulnerable in the near-term are long-horizon deep fundamental research based managers where machine learning has not yet progressed to the point of being able to replace human judgment in assessing and predicting management quality, strategy effectiveness, etc. Machines work on recognised historical patterns, making innovation and anomalies difficult to recognise using automation.

Many, but by no means the majority, of discretionary managers have woken up to the new paradigm and are investing in ‘data science’ capabilities. Simply hiring ‘quants’ will do little to enhance alpha-generating capabilities. Scale and organisational rebuilding to fully graft data science capabilities across all investment processes over a number of years is required. This brings with it all of the associated organisational risks of cultural integration having to be carefully managed. Parallels in other disrupted industries (e.g., traditional retailers launching an online offering but not focusing on making it a truly seamless customer experience) suggest that, in order to ensure success, it is critical for the corporate culture to truly embrace the change and devote sufficient resources to it even if it cannibalises some existing lines of business.

Against this rapidly changing investment manager landscape, in the name of protecting client investment performance, Partners Capital is looking to:

- Avoid the fundamental managers who are most vulnerable to disruption by systematic managers (e.g., those with shorter time frame, liquid trading strategies)

- Invest with fundamental managers who are using technology most effectively to evolve toward the hybrid ‘human + machine’ investor

- Build strategic relationships with leading systematic managers to secure access to future capacity and strategies

Technology’s Impact on Investing

Twenty years ago, one of the first examples of a machine beating a human occurred when chess champion Gary Kasparov was beaten by IBM’s supercomputer, Deep Blue. Since then, we have seen several examples of machines beating humans and the impact of technology has become a very important conversation to have in the context of investing. In 2017 a research team at Partners Capital, led by CEO Stan Miranda, spent six months talking to over 30 systematic (quantitative) managers, a similar number of discretionary (fundamental) managers and various investors and experts to help us answer four critical questions:

- What are the major technological developments impacting investing?

- Are systematic managers gaining on fundamental managers?

- What is the hybrid ‘human + machine’ model that will win in the future?

- How are the best fundamental managers turning their understanding of how technology transforms industries into alpha?

Below, we take each question in turn and provide the answers and supporting analysis derived from this research.

Question 1: What are the major technological developments impacting investing?

The technological developments transforming the investment industry are no different from those impacting many other industries today. These are:

- Growth of data storage capacity and computing power

- Big Data: explosion of non-financial data

- Advanced Algorithms: Artificial Intelligence (‘AI’) / Machine Learning

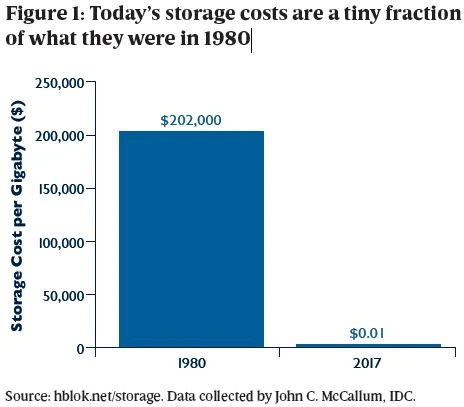

Moore’s law (the observation that the number of transistors in a dense integrated circuit doubles approximately every two years) has carried on for 50 years. In 1980, a gigabyte of storage cost $202,000 compared to 1 cent today (Figure 1). A gigabyte holds roughly the memory of a TV quality movie. There is a large pipeline of new technologies to prolong Moore’s law, including optical communication (i.e., light based communication within chips), neuromorphic computing (i.e., devices modelled on the densely linked bundles of neurons in animal brains) and quantum well transistors to boost electrical charge carriers enabling extra iterations of Moore’s Law. The Economists article ‘After Moore’s Law’ provides an excellent summary of the efforts to prolong the life of Moore’s Law (www.economist.com/technology-quarterly/2016-03-12/after-moores-law).

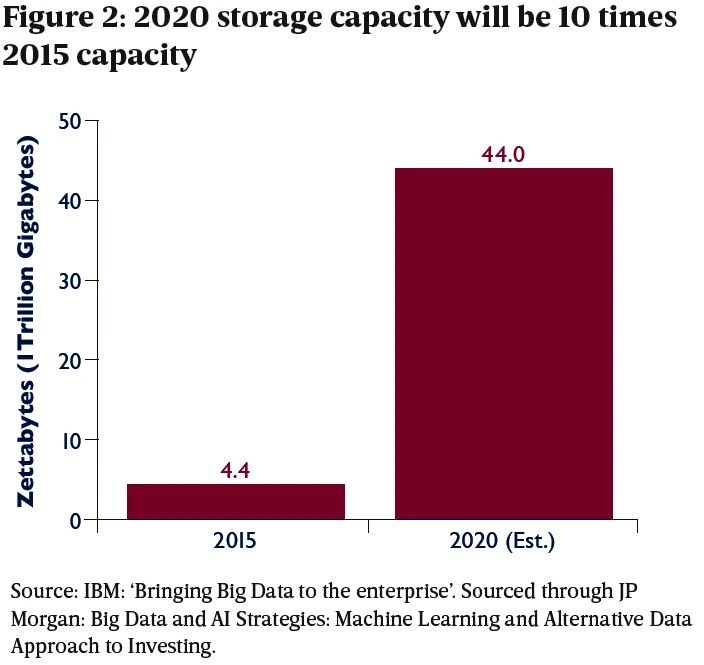

With ever cheaper storage capacity, we can expect exponential growth in its availability and usage. IBM has forecast that the total data storage capacity on the planet will grow to 44 zettabytes in 2020, a tenfold increase over five years (Figure 2). This is enough storage for 33 years of internet traffic, based on the volume of internet traffic in 2016.

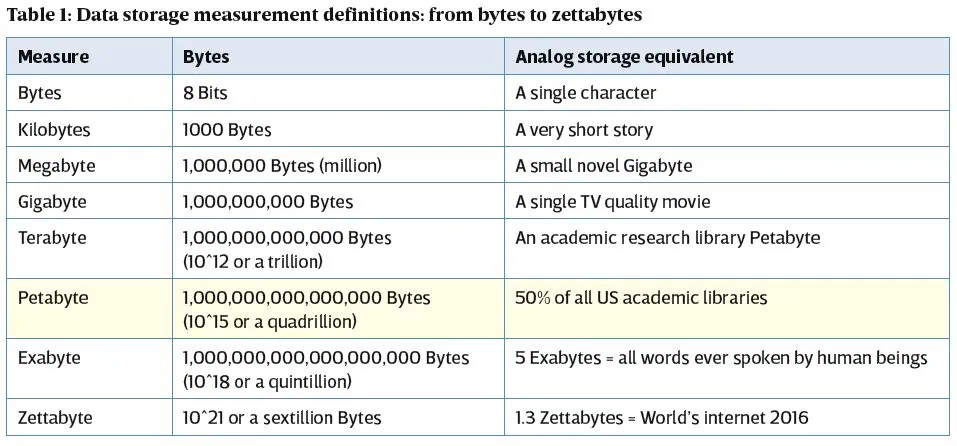

We used to talk about gigabytes of data, and maybe terabytes, however at a recent meeting with systematic hedge fund, Two Sigma, they spoke of the 35 petabytes of data they have stored today, which they expect to grow to be 120 petabytes by 2020. A petabyte is quadrillion bytes or 10 to the 15th power. In analogue terms, 120 petabytes is equal to taking all of the books and studies found in all US academic research libraries and then multiplying that by 60. Worldwide storage capacity is now measured in zettabytes, or 10 to the 21st power, which has gone beyond any analogue equivalent. Table 1 is a useful guide to data storage measurement.

In addition to growth in storage capacity and reduced storage costs, there have also been significant advancements in computing power. In the 1970’s, there were a couple of thousand transistors on integrated chips. Today, there are over 10 billion. Supercomputer processing speed has doubled every 1.5 years, with 1 million computations per second in the 1980’s and 10 trillion today. Massive computing power is now generally affordable and available to the smallest companies and even individuals through cloud based providers such as Amazon Web Services (AWS).

In the world of active investing, this substantial increase in storage capacity allows for the collection of billions of data points which are directly or indirectly related to companies, and can be analysed to identify patterns in valuations over time. Greater processing power means that more complex algorithms can be run in a timely manner without reaching the limits of that processing power. One systematic investing firm noted that the research processes that took 3 hours in 2002 now take ‘5 seconds’. This development goes hand-in-hand with the growth of ‘big data’.

Big data: explosion of non-financial data

The explosion of non-financial data available to investors today comes from human activities such as credit card transactions and business processes, including corporate internet transactions and sensors sitting in outer space in satellites. We have organised the new non-financial data into three categories:

- Individual Activity Capture, such as:

- Credit card transactions

- Social media sentiment data

- Browser clicks data

- Email receipt data from consumer transactions

- Business Processes, such as:

- Corporate ‘exhaust’ (e.g., procurement transactions)

- Government databases

- Scraping sell-side analyst reports

- Website scraping including news

- Sensors, such as:

- Cell phone GPS location data

- Satellite images

- Shipping data

- Internet of Things (IoT) Sensors

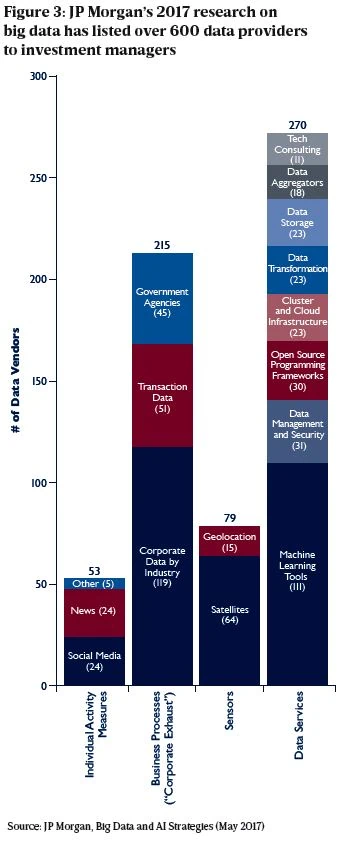

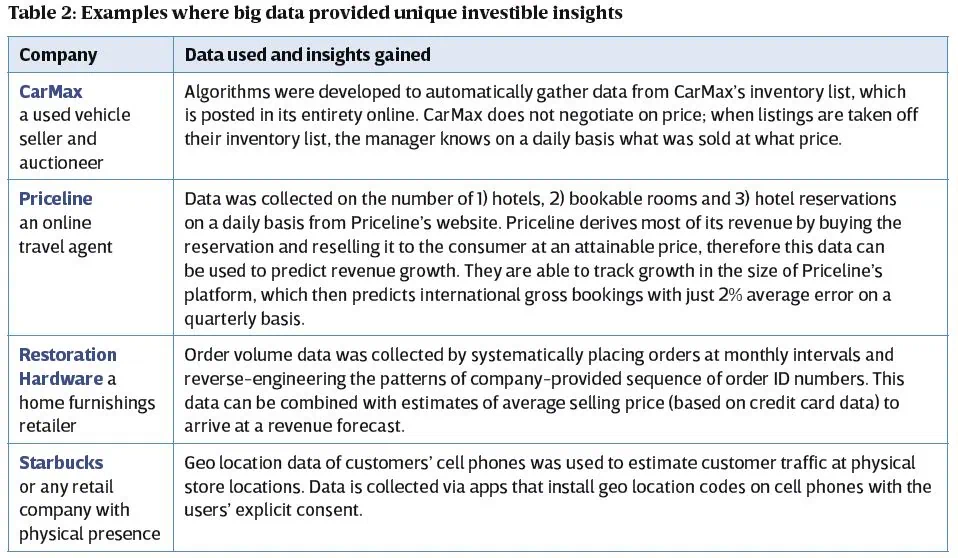

One example of a newly launched data supplier to the investment industry is Orbital Insights (one of the 79 sensors-based data providers shown in Figure 3). Orbital Insights is focused on predicting short-term movements in oil prices based on satellite image based estimates of inventory levels. Oil reserves are often stored in floating tanks around the world, whose lids rise and fall with increasing or decreasing storage levels. With the rising and falling height, the crescent shaped shadows cast by the sun also change shape. By tracking these shape changes for 20,000 tanks around the world, Orbital Insights predicts short-term movement in oil inventory levels and oil prices with remarkable accuracy. To bring the value of big data to life, Table 2 below provides some actual examples of where active investors have used new sources of data to provide analytical insights about the prospects for different companies.

Advanced algorithms: artificial intelligence/ machine learning

Artificial Intelligence has many varying definitions. For our purposes, we define it as the development of computer algorithms able to perform multi-step functions that normally require human intelligence such as visual perception and speech recognition. Some subsets of AI include Machine Learning, Natural Language Processing, Deep Learning and Reinforcement Learning. In finance, AI can be used throughout the investment process, from identifying and cleaning databases to leveraging high volumes of data (‘Big Data’) in order to discover repeatable patterns to predict asset pricing. In active investing, supervised machine learning is the most progressed in predicting asset prices.

Machine learning in investing generally refers to data analysis where the computer builds its own predictive models, as opposed to employing models built by humans, using algorithms that iteratively learn from data. The computer ‘learns’ and improves the model’s predictive capability over time based on the data it has been fed and patterns it recognises without human intervention. This allows computers to find patterns without being explicitly programmed where to look. Machine learning algorithms aim to identify complex and potentially non-linear relationships, such as prediction rules for stock forecasts from a vast amount of data. Because of the massive amounts of data necessary, machine learning is only valuable with dramatic increases in processing power.

Machine learning is relatively new to active investing and has not proven itself yet to be a source of greater alpha. The biggest hurdle that managers are seeking to overcome is the non-stationarity of the data – that is, unlike the rules or driving or chess for example, the inputs into financial models are constantly changing and evolving. This makes it very difficult to find longterm sustainable patterns, necessitating more complex algorithms. There is a trade-off, however, between the complexity of the algorithms and interpretability of the results. The more complex the processes, the more random the relationship between the variables appears to be.

Large systematic investors such as Renaissance, AQR, Two Sigma and D.E. Shaw have long used complex algorithms in their investment processes and are actively researching ways to continue expanding their use of more advanced techniques, such as machine learning. Many of their founders and senior research team members have their academic and career roots in machine learning research. Their models are increasingly incorporating programs that have theability to alter algorithms based on the magnitude of observed success or failure in trading from a set of data relationships. All of these firms, however, have commented that they do not feel they are anywhere near fully substituting human judgement with machine learning/AI. The most commonly cited reason is that they believe that the noise in the financial markets makes it perilous to exclude human inputs from the research and investment process.

One of the largest advocates of machine learning in active investing is WorldQuant. The systematic investment firm, which manages substantial capital for multi-strategy firm Millennium, has leveraged machine learning techniques to develop a library of millions of alpha signals that its portfolio managers can employ alongside human developed alpha signals. They note that the human developed alphas are typically higher quality and have better performance once taken out of testing phases, but the production capacity is limited by headcount (they have over 300 researchers) and human limitations. Machines, on the other hand, can run a billion simulations per month and, using that brute force, can identify undiscovered patterns in data. These patterns can identify price relationships or trends which yield small gains on thousands of individual transactions in short periods of time. Today, over 80% of the alpha signals that World Quant leverages are machine generated. More recently, more dedicated machine learning based strategies have emerged, mostly from hedge funds operating on the West Coast. These include firms like Voleon, whose founders spent the early years of their careers at D.E. Shaw, and then managed capital for SAC Capital. Voleon deploys a strategy centred around machine learning with few investment professionals being part of the team, relying instead on physicists, computer scientists and engineers to build state of the art algorithms. Others have followed Voleon including Sentient (a hedge fund launched by the firm that developed the technology forming the basis for Apple’s Siri), Voloridge, and Cerebellum Capital; all are now managing capital for third party investors. Performance has not yet suggested machine learning strategies to be superior to more traditional algorithmic trading strategies, whether the latter are incorporating machine learning or not. Importantly, these firms have also discovered a significant pitfall of machine learning strategies when it comes to managing external capital. Because of the complexity of the algorithms it can be impossible to explain unusual performance or why a portfolio looks the way it does. This can make investing in these strategies a non-starter for allocators who want to understand why their funds are performing the way they are.

While processing power and big data are clearly bringing new capability to systematic and fundamental investors, we are still watching for tangible advances from the use of artificial intelligence and machine learning.

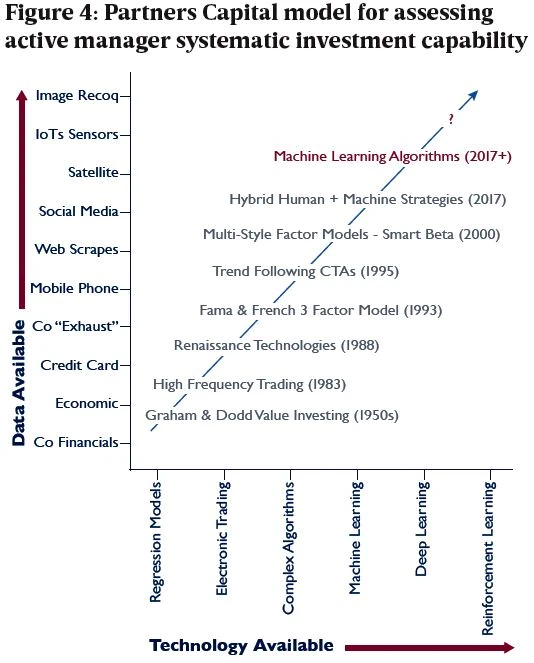

That being said, our model for assessing the systematic investment capability of any systematic or fundamental investor is shown in Figure 4, defining that capability along three dimensions which are closely aligned with the three technology trends described above. Systematic investment capability is measured by: 1) data harnessed by the manager (y-axis), 2) technology adopted by the manager (x-axis) and 3) the processing power available to exploit the enlarged data set and technological engine (the 45 degree vector). We illustrate the historical evolution of systematic investing by plotting past systematic investors on this grid.

This framework is presently being used by our research team in discussions with our existing and new managers to assess the extent to which the manager is evolving relative to their competitors.

Question 2: Are systematic managers gaining on fundamental managers?

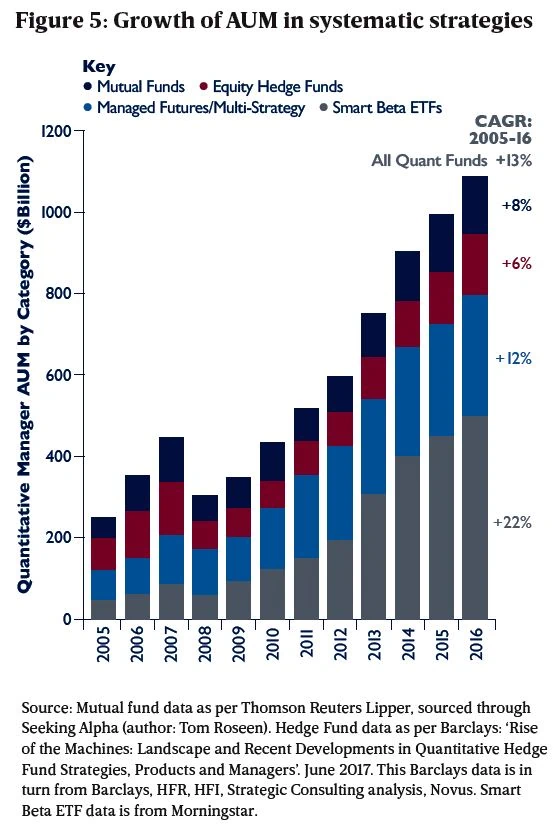

Assets invested by systematic hedge funds, long only equity managers and ETFs have grown over the last 12 years at a rate of 13% per annum (Figure 5). This compares to approximately 6% for the asset management industry overall. However, much of the gains on fundamental managers have come from socalled smart beta products, which provide investors with low cost exposure to style factors such as value, momentum and quality. Systematic hedge funds have grown at very similar rates to that of the overall hedge fund industry in the last 12 years, at approximately 9% per annum.

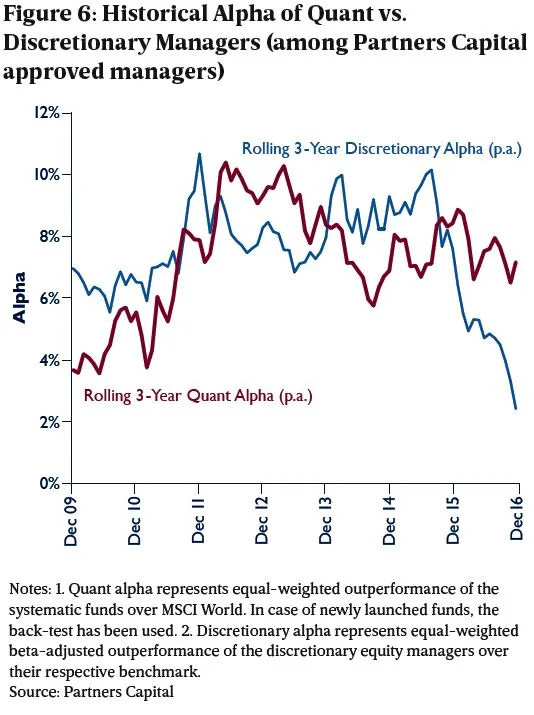

Performance of systematic vs. fundamental strategies. There does not appear to be any clear evidence that systematic managers are beating discretionary managers across various strategies today if we compare their average three year rolling alpha. Recent history shows systematic equity hedge funds catching up with fundamental strategies with little differentiation in performance today. However, if we focus on the best systematic managers and look at their rolling three year alpha against the best fundamental equity managers (based on the current line-up of 10 Partners Capital approved systematic managers versus our 20 approved fundamental equity managers), the systematic managers have recently pulled ahead averaging around 700bps of net alpha versus 300bps for fundamental managers. We note, however, this reflects a precipitous drop in fundamental manager alpha as a result of the Q1 2016 recession scare and related sell-off of growth and momentum equities, as can be seen in Figure 6 below.

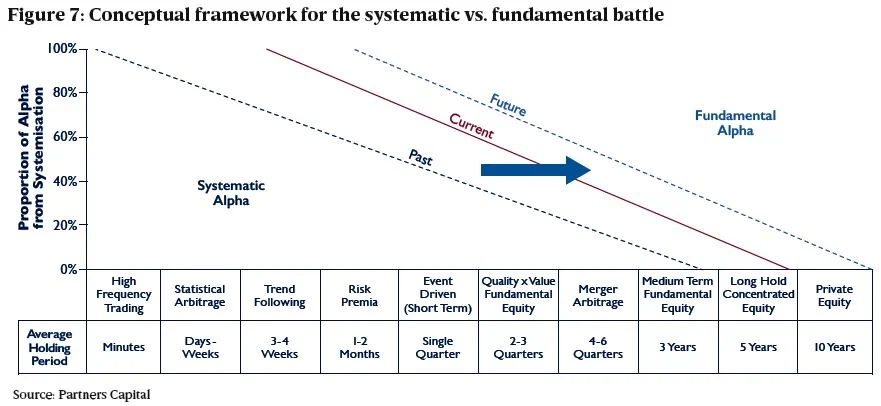

As we extrapolate our findings more generally on systematic versus fundamental investing into the future, we believe that systematic capability will take share of alpha from fundamental capability increasingly over time. Such gains will take place mostly where fundamental investors have relatively short investment time frames as this is where the data is more readily available and analysis more systemitisable. For example, fundamental equity managers focused on predicting quarterly earnings surprises should see systematic managers increasingly doing a better job of this. Similarly, winning merger arbitrage strategies should be more systematic in their approach. Figures 7 illustrates a conceptual framework for how we think this will play out over time.

Towards the left on the x-axis you have the shortest time frame hedge fund strategies such as high frequency trading (think Michael Lewis’ Flash Boys) and statistical arbitrage. At this short end of the investment time horizon spectrum, we see quantitative managers owning the majority of the alpha today. Towards the right you have longer term strategies such as activist equity investing in concentrated long hold equity portfolios. Here fundamental managers dominate the share of alpha versus systematic managers. The battle ground being fought over between systematic and fundamental managers is occurring in the strategies with one month to one year time horizons including event driven strategies such as merger arbitrage. As systematic managers continue to add new data and processing power more rapidly than fundamental managers, we expect to see quant managers gradually taking share of alpha from the fundamental managers in this middle ground, where it is easier to automate insights around quarterly earnings estimates and similar events.

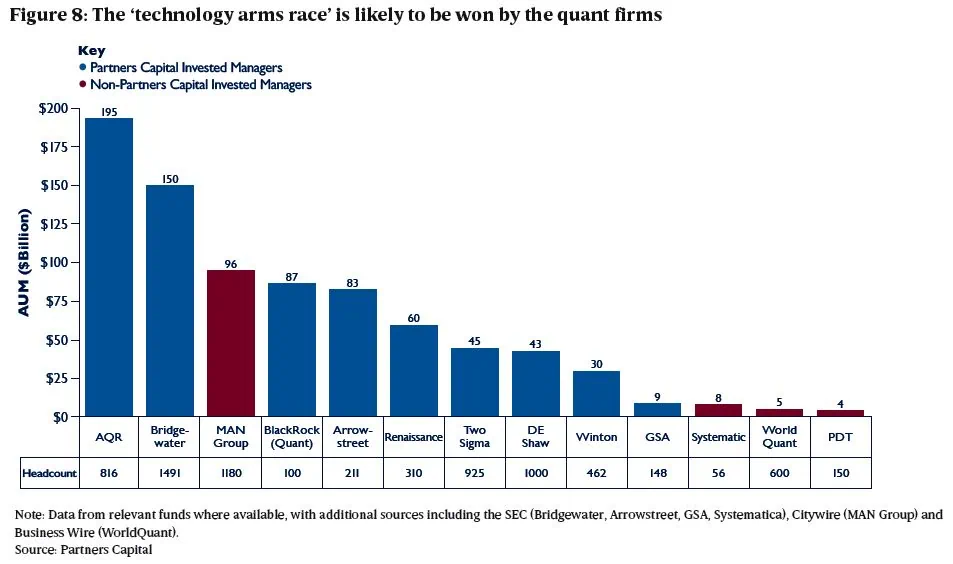

In this conceptual model, we see systematic managers gradually working their way from left to right in garnering alpha from fundamental managers in the coming years. This all assumes that fundamental managers will not fight back with their own systematic add-on models. But what makes us feel more confident that the quants will win in the middle time horizon battlefield is their sheer size and resources. Figure 8 below shows the scale of assets managed by the largest quant firms. Add to this the high fees earned, one can estimate the amount of resources likely to continue to be invested in growing their technological capabilities.

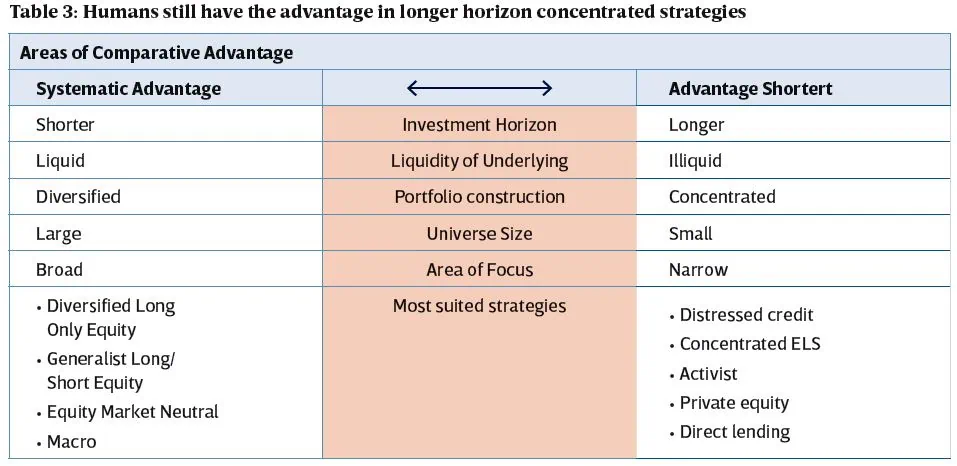

A good model for deciphering which strategies are most vulnerable versus most defensible is shown in Table 3. While systematic firms will make significant headways as we describe above, humans will still have the advantage in longer horizon concentrated strategies. However, most discretionary hedge funds still expect a blend of systematic and fundamental approaches will generate the highest levels of alpha going forward in the middle time horizon strategies.

Question 3: What is the hybrid ‘human + machine’ model that will win in the future?

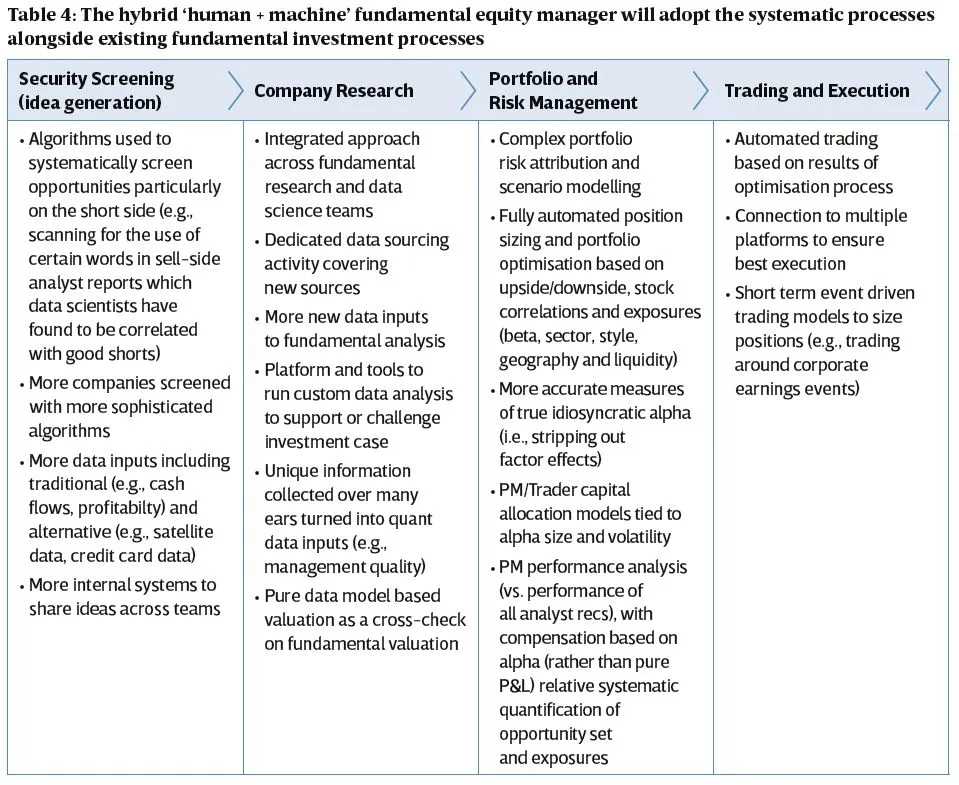

Quite simply, the most successful hybrid human + machine fundamental manager of the future will be one which most successfully adopts the best practices of some of the most effective systematic managers across all four elements of the investment process. Technology in fundamental houses can be used in security screening, company research, portfolio construction, risk management, internal performance

evaluation and trading and execution. We describe these in the Table 4 below in more detail.

Fundamental managers who graft systematic capabilities and employ integrated fundamental analysts and data science teams are likely to be the winners in the battle ground area outlined above.

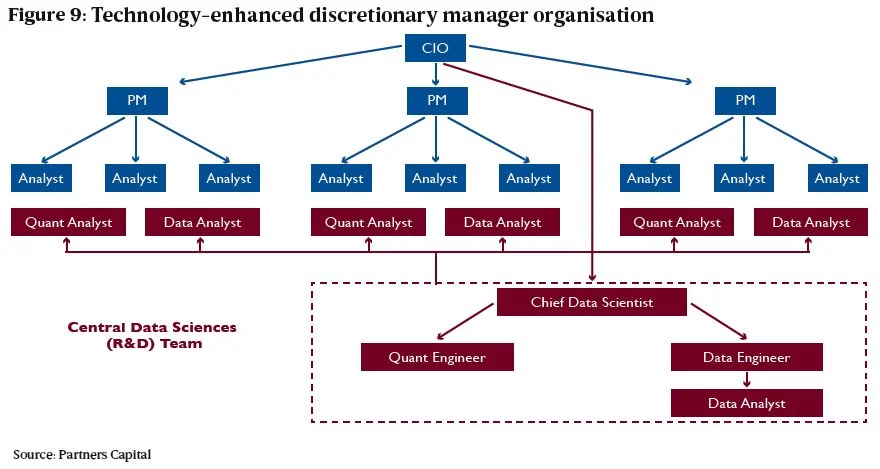

Figure 9 below represents an organisational chart of the hybrid model of the future where fundamental and quantitative research teams work side by side, supported by a strong central data sciences function. Few firms today come close to deploying this model, given the significant recruiting cost and cultural integration challenges; however, steps in this direction should be rewarded over time with superior returns.

Question 4: How are the best fundamental managers turning their understanding of how technology transforms industries into alpha?

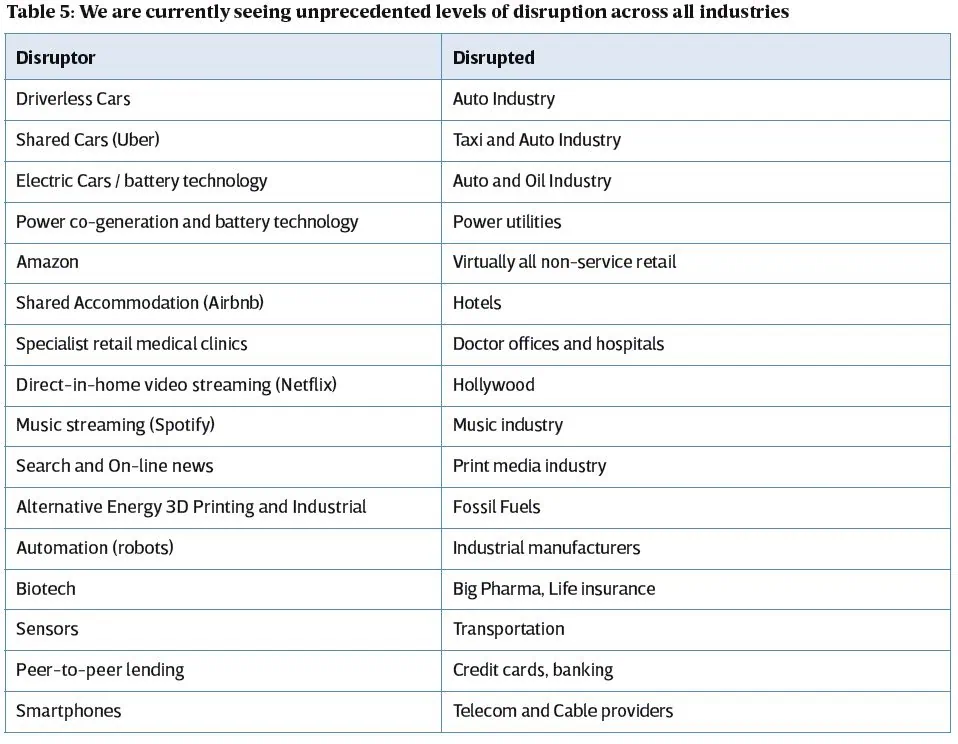

While innovation is not new to businesses and industries, in our opinion, the pace and magnitude of innovation is greater than it has ever been in history. There is barely a single industry that is not being affected by technological change and innovation more broadly, as shown in Table 5.

As a result of the pace of change, we believe that our fundamental active managers need to invest in an entirely new lens through which to analyse companies and industries to fully understand how technology and innovation is redefining the universe of winners and losers. Over the course of 2017, during our routine meetings with our approved asset managers and prospective new managers, we discussed what they are doing differently to fully understand how industries and companies are being disrupted. A few of our managers have evolved to build this understanding. The best tended to be in the private equity world where they have long engaged external experts on whatever learning they felt they did not have in-house to properly assess their new investments, but also to add value to them after acquisition. However, in our opinion, many of the most talented active fundamental investors have not gained a level of insight to the point where it constitutes a competitive advantage in their ongoing search for alpha.

What would we expect to have heard from our managers? We would have expected to hear that they do have a new lens of sorts and that lens is built by leveraging industry experts who have the deepest insight into how specific technologies and other innovations are changing industry boundaries and sources of competitive advantage. This will enable them to see in advance where new competitors are coming, be they from sectors far afield or from newly born industries (e.g., the auto and taxi industries being disrupted by ridesharing companies such as Uber). They will see winning business models are changing as key performance drivers change. They will be looking for companies who are distributing what was their central IT function to create deep technological capabilities in all corners of the organisation. They will be looking for changing organisational structures, where departmental silos are being torn down, decentralised and redefined to enhance cross organisation coordination. They will see that the most productive company culture looking forward will have a greater appetite for taking risk and will be the first to abandon traditional hierarchical decision-making. The insightful fundamental investors will be able to assess where different CEO’s and C-Suites have more or less capability to evolve their companies. They will view almost every company as a ‘technology company,’ even in the most service oriented and lowtech of industries. This is the new lens we are working with our managers to appreciate and embrace.

But we are not waiting for our incumbent managers to transform their analytical approaches where we feel that is not in the cards. We have already found and invested in new managers who are explicitly set up to exploit their insights into disruption across industries. One recent example is our investment in the Sequoia Global Equities Fund, based on the West Coast, where a relatively small dedicated public equity investing team has access to 96 Sequoia investment professionals globally who can glean insights from investments in over 800+ Sequoia venture capital backed tech companies.

We expect to continue our push in 2018 into our investment theme of exploiting technological disruption through our incumbent managers who are clearly pushing their capabilities forward in this area and into new managers demonstrating superior alpha delivery through their insights.

Implications for Partners Capital in managing your portfolios

Summarising our conclusions on the topic of how technology is impacting active investing, we feel the following points are the most critical for our clients to take away:

- All fundamental asset managers must be certain that they have the capabilities internally or externally to understand how industries and companies are being affected by technological innovation.

- Many strategies will not be materially affected by technology in the near or medium term, including those with very long time horizons and with relatively concentrated portfolio holdings. Private equity, distressed investing and long hold activist public equities are examples of those least affected.

- Avoid the fundamental managers who are most vulnerable to systematic managers – those with shorter time frame, liquid trading strategies.

- Back fundamental managers who are using technology most effectively in evolving towards the hybrid ‘human + machine’ investor.

- Build strategic relationships with leading systematic managers to secure access to future capacity and strategies.

- Finally, Partners Capital also needs to become a ‘technology company’ in its own use of data and analysis of client portfolios and asset managers. We believe that we are already leading our Outsourced Investment Office competitors and are making significant further investment to this end.